- 2019.03.01(金)04:45 カバード・プット NY市場ランチタイム

- ネコ耳スプレッドに想いを馳せる

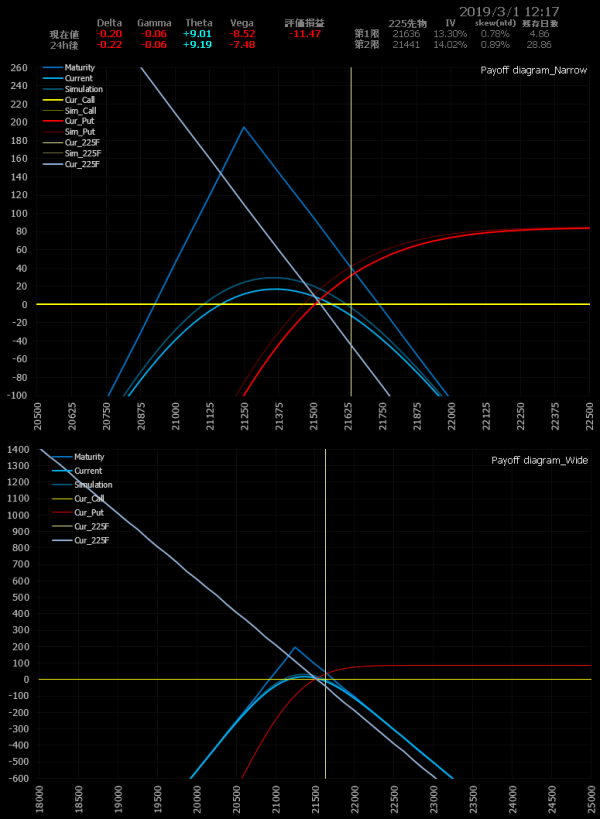

- 2019.03.01(金)12:15 ミニ売追加 東京市場ランチタイム

- 2019.03.02(土)04:55 ミニ売追加 NYタイム午後

- 2019.03.05(火)01:35 NY市場午前

- 2019.03.06(水)13:40 魔の水曜日 東京市場午後

- 2019.03.06(水)14:45 タイマー注文観測 先物を仕掛ける前の仕込みか

- 2019.03.07(木)05:00 NY市場午後

- 2019.03.07(木)09:00 東京市場オープン経過

- 2019.03.07(木)13:45 ミニ売り返済

- 2019.03.07(木)15:05 全返済

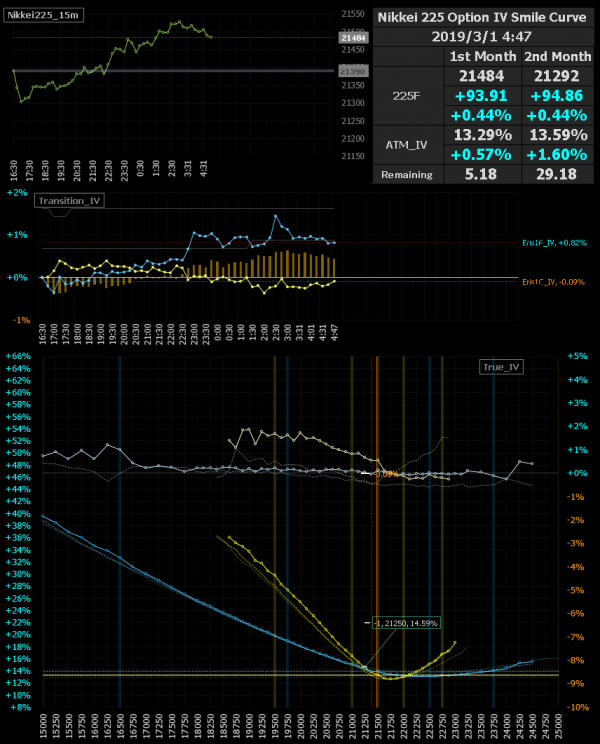

2019.03.01(金)04:45 カバード・プット NY市場ランチタイム

今週は動きが止まってしまった日経先物。政治経済イベントは多数あれど、結局21500円を挟んで±200円程度のレンジ。為替は111円台に乗せてきている。

低下傾向のIVは、今日のところは盛り返してくる展開。VIXは14%台をキープ。

最近のマーケット環境では苦手なショート(オプションの)のアイデアしか浮かばず、ポジションを取るのに二の足を踏んでいたが、ようやく「カバード・プット」をエントリー。ここら辺のやるべき仕事を淡々とこなせないメンタルの甘さを感じる。アルゴ作りたいなぁ。

NSオープン後には印パやトランプリスクで急落する場面もあり、プットは盛ってきた。結局この時間21500円まで全戻しするも、未だ盛り残っているOTMプットの剥げを狙うポジション。

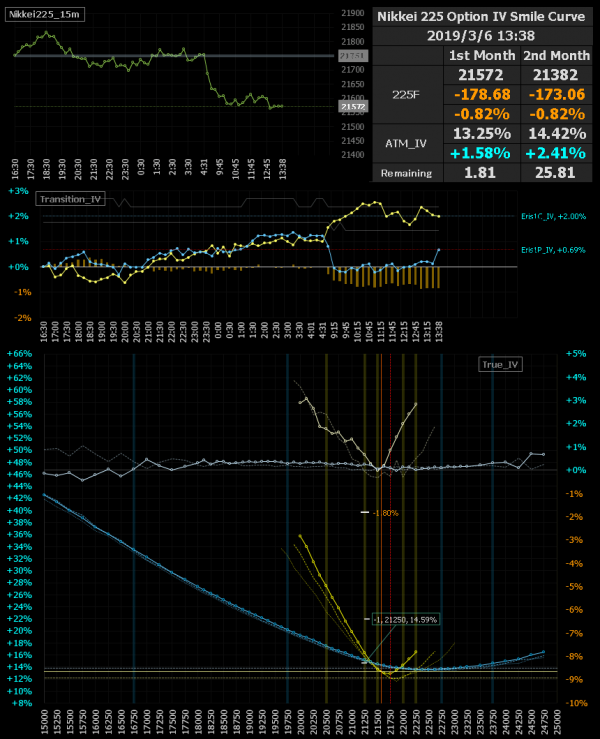

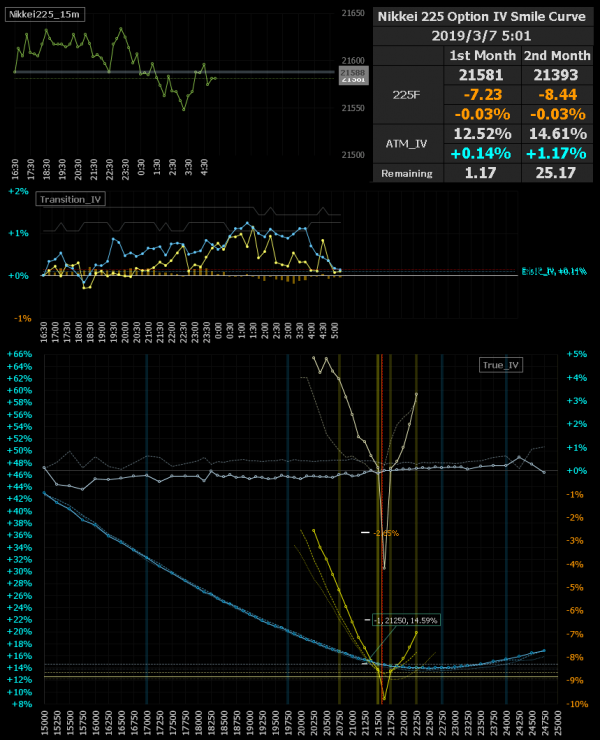

と言うのも、スマイルカーブの画像をご覧いただくとわかる通り、見事な「上げのP盛りC剥げ」となっている。この素晴らしく美しい曲線は「スライド効果」によるもの。

来週はSQ週。21250円~上限22000円までのレンジを想定しているポジションだが、日経先物と為替は昨年10月以降の戻り抵抗ライン100SMAまで戻してきているので、いつ反転下落に向かってもおかしくはない。……と誰しもが考えているのでダブルインバースが良く売れるのだろうか。良くわからないけど。

毎度毎度しつこいようだが「即死ポジション」を取っているときは努々監視を怠るなかれ。自分のためだ。

前回のレポートでは、”好き嫌いは置いといて、オプションを売るときは売るし、買うときは買う”などとカッコつけて書いてしまったが、(オプションの)ショートは安心して眠れなくなるので正直キライ。わたしが取るようなご覧の通りの「ショッポい」ポジションのミニマムグリークスですら落ち着かないのだから、そもそも性に合っていないのだと思う。本当に苦手だ。

ネコ耳スプレッドに想いを馳せる

それでも3.11までは「ネコ耳スプレッド」などと命名し、コールとプットでレシオ・スプレッドを組むのがいつもの手筋だった。当然レシオ・スプレッドはショート・スプレッド。

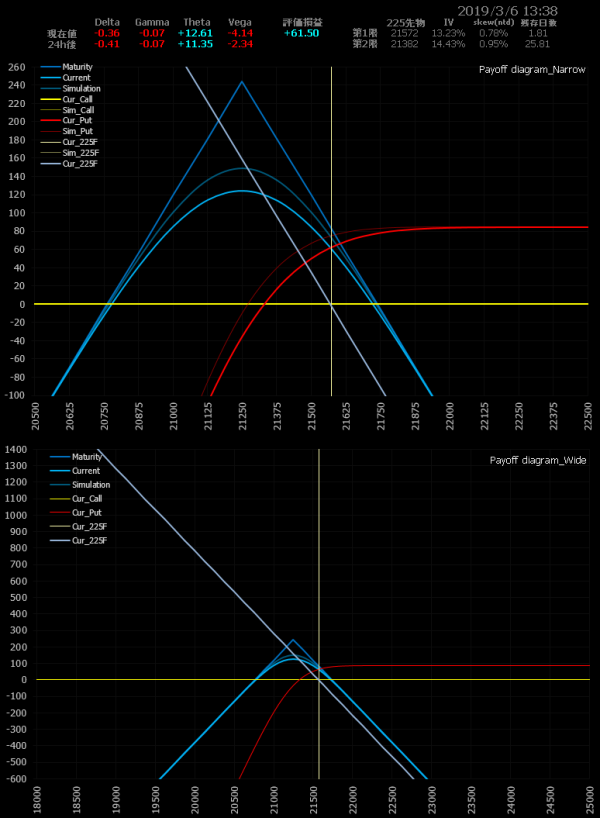

仮にいま「ネコ耳スプレッド」を組むとこんな感じになるだろう。+1:-5~-10くらいの比率でコール側とプット側の両サイドで同時に作る。ほとんど大外の「ショート・ストラングル」状態。満期の損益線がネコ耳のシルエットとなるので「ネコ耳スプレッド」。

時間経過で売玉が萎むと更に手前を売ってセータを補充していく。満期SQ持ち込みが基本で、買玉がITMで決まればラッキーボーナス。INすればするほど儲かり、売玉は大外なのでまず届かない。ITMしなくてもクレジットで負けナシ。ああ、こんなオイシイ手法ないですわ、という訳。

スマイルカーブやグリークスなど何も知らずともバカみたいに儲かるので、毎回毎回ソレしかやっていなかった。「バカの一つ覚え」とはまさにこのことだ。「ネコ耳スプレッド」最強、これで一生食っていける、ついに聖杯にたどり着いたのだ、と真剣に考えていた。その自信を揺るがす恐ろしいことは何も起こらなかったので、恐怖は全くなかった。

今はなき「ひまわり証券」の当時の売建て証拠金はFOTMプットなら8,000円、200枚まで売れた。「ひまわり証券」のオプション取引ツールは使いやすく最強の証券会社だった。未だに「ひまわり証券」を超えるオプション取引ツールを提供している証券会社はない。

プロもアマも若輩も老兵も皆同じテーブルにカネを置き真剣な勝負をしているのですから、ルールも知らずに(知ったつもりで)賭けるなんて、カモだね養分だねと小バカにされても仕方がないでしょう。

ハイ、このこと。「ネコ耳スプレッド」、自分がオプション市場で何をやっているのか何もわかっていなかった。

また話が脱線してしまった。わたしが3.11で吹き飛ぶ切欠となった「ネコ耳スプレッド」の話の続きは、また次の機会にでも。TPOをわきまえれば優秀なスプレッドの一つだと今でも思っているのは、華々しい勝利体験があるからなのか。足がすくんで組めないけど。

3.11で吹き飛ぶ切欠?以下のレポートのこと。良かったら合わせてどうぞ。

2019.03.01(金)12:15 ミニ売追加 東京市場ランチタイム

日替わりで上下する日経先物は年初来高値を更新。為替は111円台後半まで円安が進む。

スマイルカーブの画像から「スライド効果」が分かりやすい状態で観測できる。IV前日比ラインもキレイにバックスラッシュとなる。

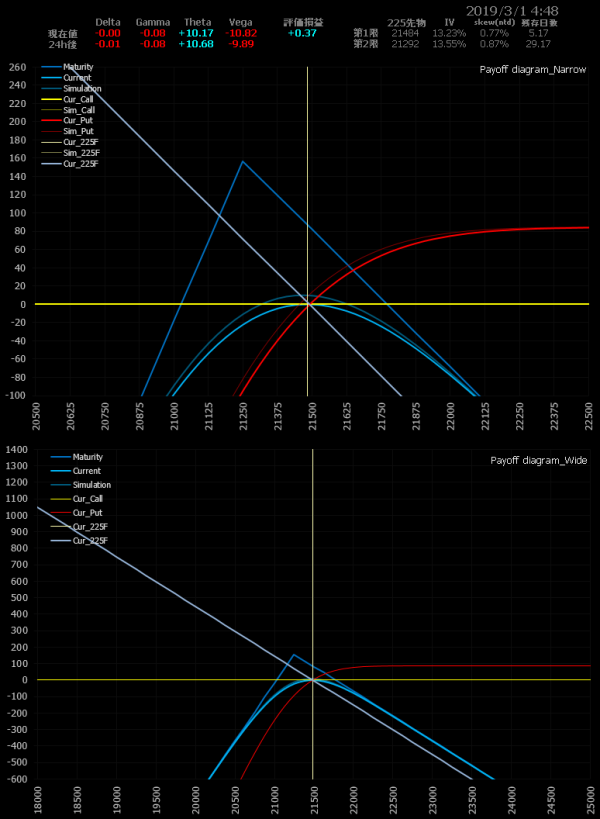

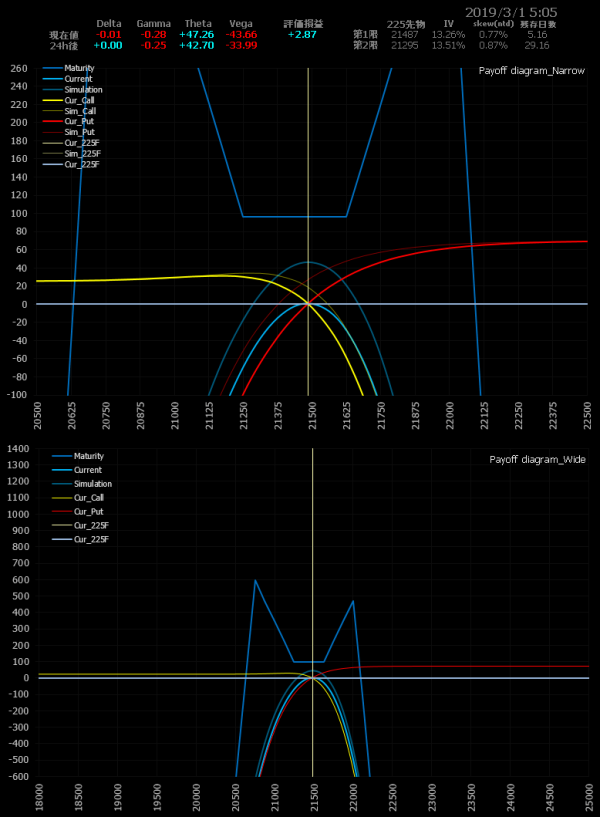

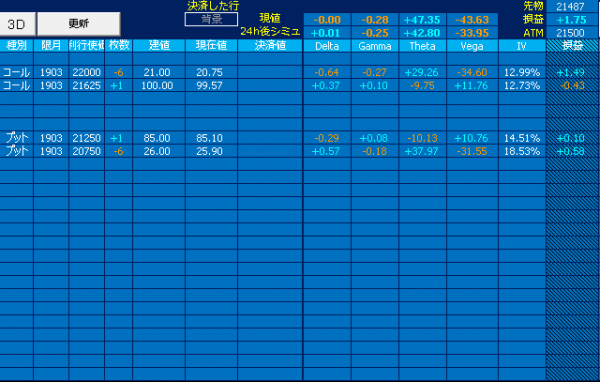

さて、ポジションの方はというと、OTMプットが盛っていることでカバード・プットの損益は悪化。ランチタイムに一段高したところでミニ売りを1枚追加。ショートに傾いたデルタを更にショートに傾けます。

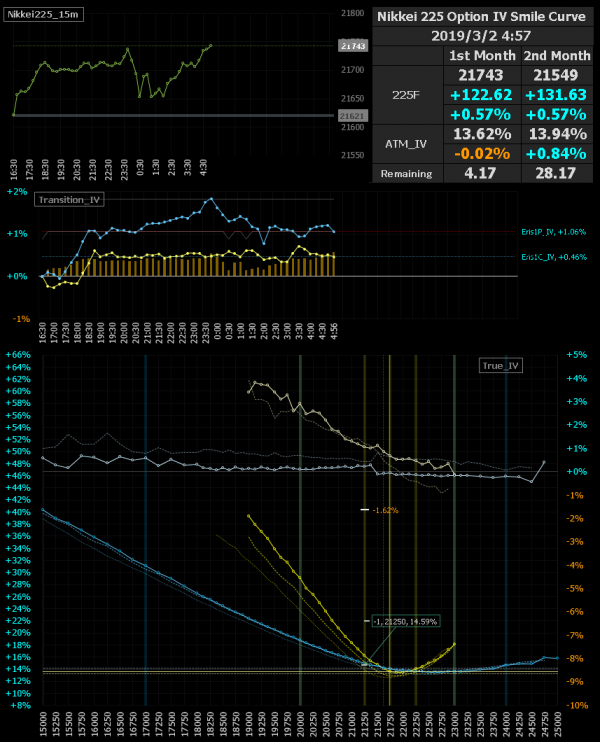

2019.03.02(土)04:55 ミニ売追加 NYタイム午後

堅調に推移する日経先物。為替は112円にタッチ。まもなくNSもクローズする。

スライドが進むIV。コールが盛ってきているのが観察できる。

「カバード・プット」の損益は更に悪化。ミニ売りを1枚追加し、このまま週越え。

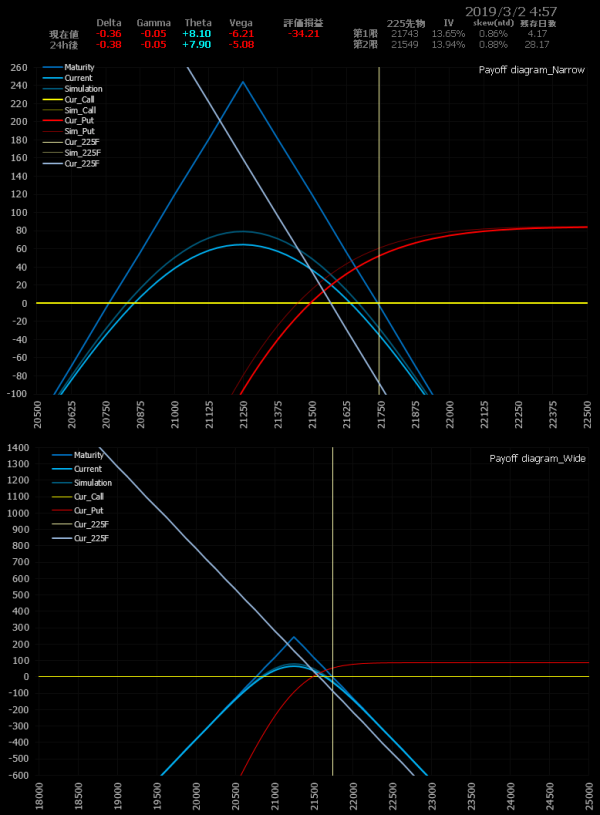

2019.03.05(火)01:35 NY市場午前

週が明けて東京タイムには21900円目前まで上昇する局面もあった日経先物。21800円台で高値持ち合いを続けていたが、この時間になってダウが若干弱含んできたことで失速。どうも狙い通りに下げターンに入ったようだ。

日経先物下落で「下げのP剥げC盛り」。満期が迫ったSQ週の期近は、単に需給の都合で動くことも多く、スマイルカーブにあまり意味はない。

ポジションは「カバード・プット」をホールド。評価はようやくプラ転しそうだが、今後の日経先物の動向次第。

2019.03.06(水)13:40 魔の水曜日 東京市場午後

「魔水」の東京市場。下落ターンが継続している。珍しいことに寄り付きギャップを未だに埋めずに安値でもみ合っており、この様子だと相当弱いのかもしれない。

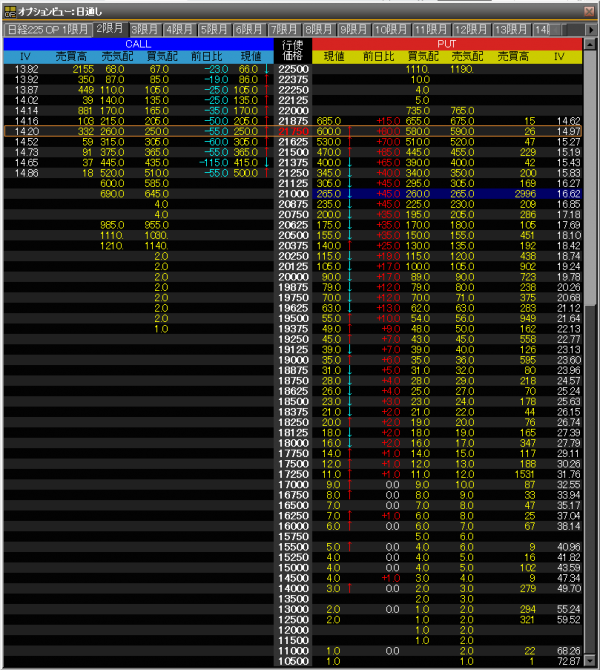

満期直前の期近スマイルカーブは当てにならないが、期先を見ると「下げのP剥げC盛り」となっているのが観察できる。

ポジションは「カバード・プット」をホールド。言いたいだけだが、今日は魔の水曜日「魔水」、ということで、これから明日最終売買日までに急落していく局面があるかもしれない。前場から観測されているプットの「タイマー注文」がその確信を深める。先物動向次第でチャンスがあればポジションを返済してしまおう。

2019.03.06(水)14:45 タイマー注文観測 先物を仕掛ける前の仕込みか

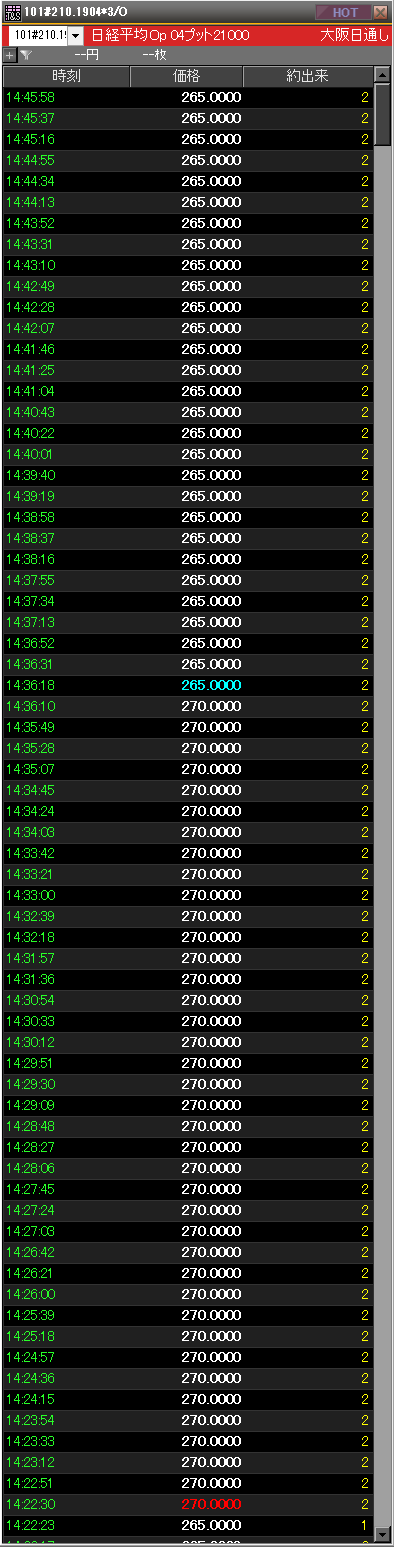

東京市場はまもなく大引け。記念パシャリ。画像が縦長過ぎて見づらいのはご勘弁を。

先ほど少し書いたが、1904P21000で出来が突出しており日中では珍しい「タイマー注文」の観測。アルゴ注文とかスライス注文とか呼び方は様々だが、今回は「21秒毎に2枚づつ」売り板にぶつけて買ってきている。1分間に6枚、前場からこの時間まで休みなく淡々と買っているので相当枚集まっているのではないだろうか。

手口的に解釈するなら「先物で仕掛ける前の仕込み」かもしれないと考えられるので、覚えておいて損はないだろう。SQ値を腕力で何とかしようとするのは「手負いの虎」がやることなので仕掛ける側も必死だ。ムリに逆らわない方が良い。

また夜間の流動性の薄い時間に「タイマー注文」を見かけたとき、明らかにこちら側の有利で玉が売れそう(買えそう)なら、躊躇せずに何度でも回転売買した方が良いだろう。中抜けの薄い板でもアルゴはお構いなしにぶつけてきてくれる。

2019.03.07(木)05:00 NY市場午後

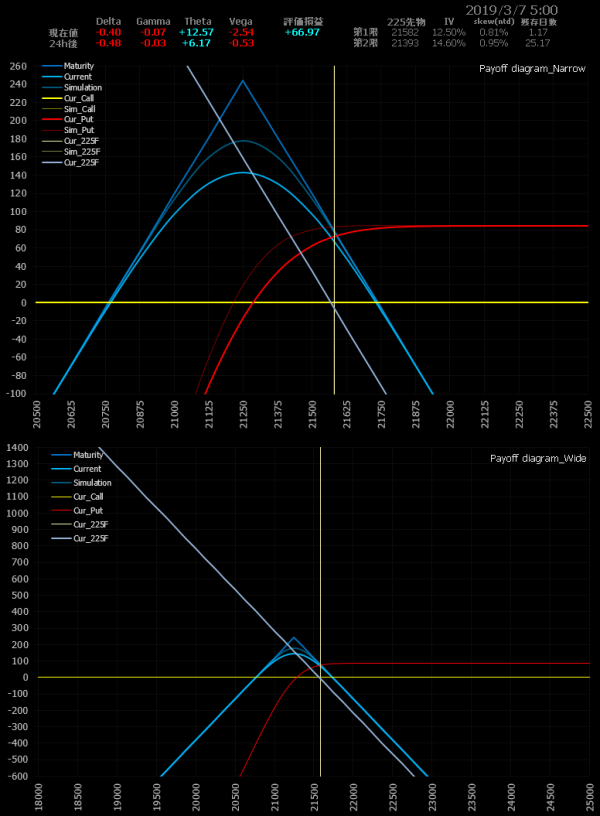

NY市場午後、まもなくNSもクローズ。先物水準は日中午後から変わらず、見事なヨコヨコ。カバード・プットをホールド。

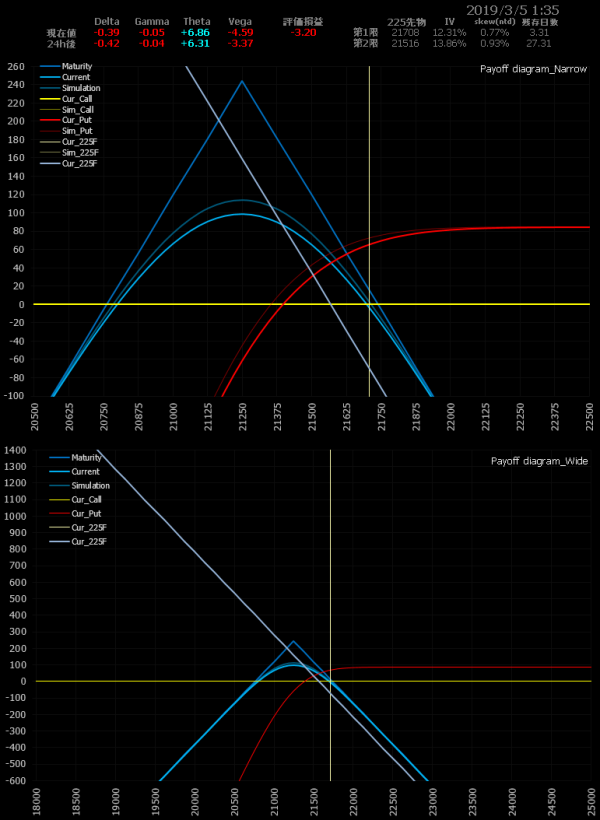

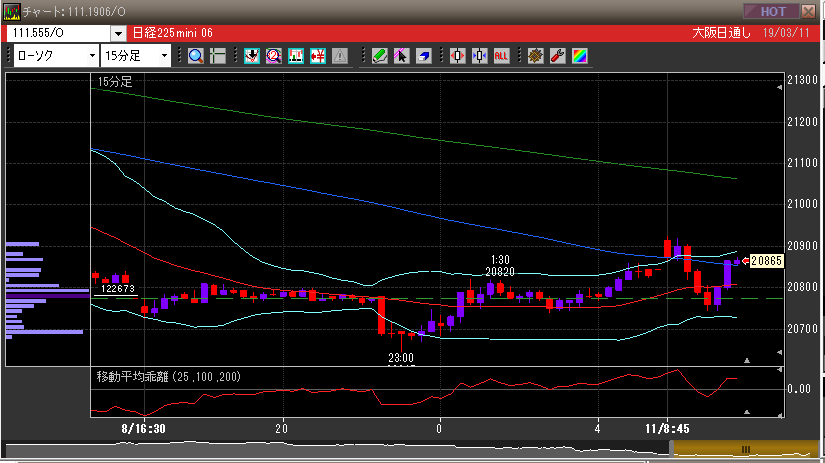

2019.03.07(木)09:00 東京市場オープン経過

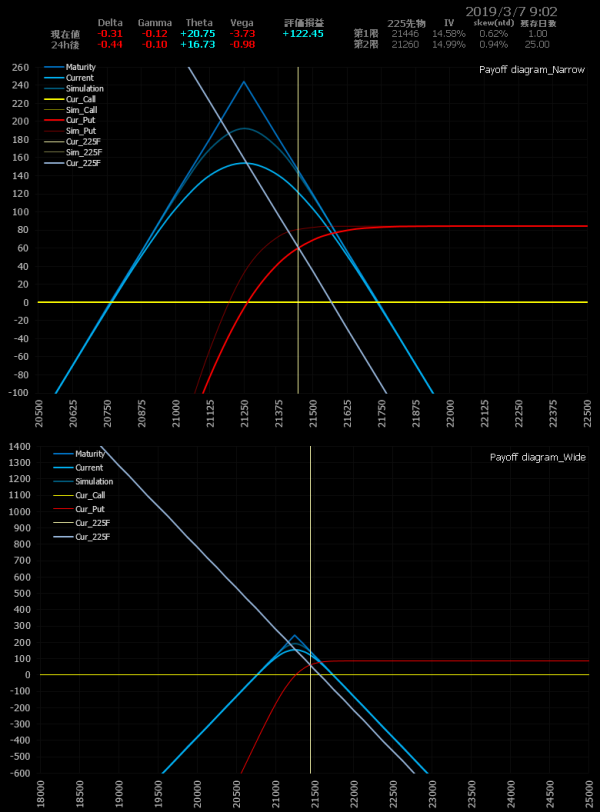

1903SQ最終売買日。言いたいだけだが、魔の木曜日「魔木」。下窓を開けてスタートする日経先物。

ポジションはSQ持込はせず日中の東京タイムで返済してしまおう。このレポートの上からペイオフダイアグラムの画像の順に追って見ると、現在損益線(水色)が時間経過で満期線(濃い青)のピラミッド完成に近づいていくのが良くわかる。

2019.03.07(木)13:45 ミニ売り返済

寄り付き後の安値は21410円、値幅は小さく未だこの水準で安値持ち合いを続けている日経先物。今にも急落していきそうなチャートをしているが、ここから叩き売ってくる雰囲気的はなく、下押しもこの水準までなのか。

ミニ売りを返済し、カバード・プットは解体。プット裸売りは即逃げ姿勢を取りつつとりあえずホールド。これからBOJ期待で日経先物がリバウンドする局面があるかもしれない。現在24円のプット・オプションは残り1時間チョイでいくらになるのか。

1903M @-5qty 21569.00 JPY -> 21415.00 JPY (+77,000 JPY)

This profit and loss +77,000 JPY

Total profit and loss +77,000 JPY

2019.03.07(木)15:05 全返済

まもなく最終売買日がクローズ。プット裸売りも返済し、全返済完了。一片の悔いナシ。

1903P21250 @-1pty 85.00 JPY -> 17.00 JPY (+68.000 JPY)

This profit and loss +68,000 JPY

Total profit and loss +145,000 JPY

NSからは期近1904月限、期先は1905月限。明日はNFP、週末は東京ドーム(もしお会いできましたら名刺でも受け取ってやってください)、来週は「BOJ」、再来週は「FOMC」、4月末から10「連休」も控えている。さて、どのような戦略で行こうか。考えるのがまた楽しい。