今回のレポートはボツ稿にするつもりだったが、反面教師にしていただければと思いアップすることにした。トレード的にはすこぶる低品質なレポートになってしまったが、リアルなところでもあるのでそこはご容赦いただければと思う。

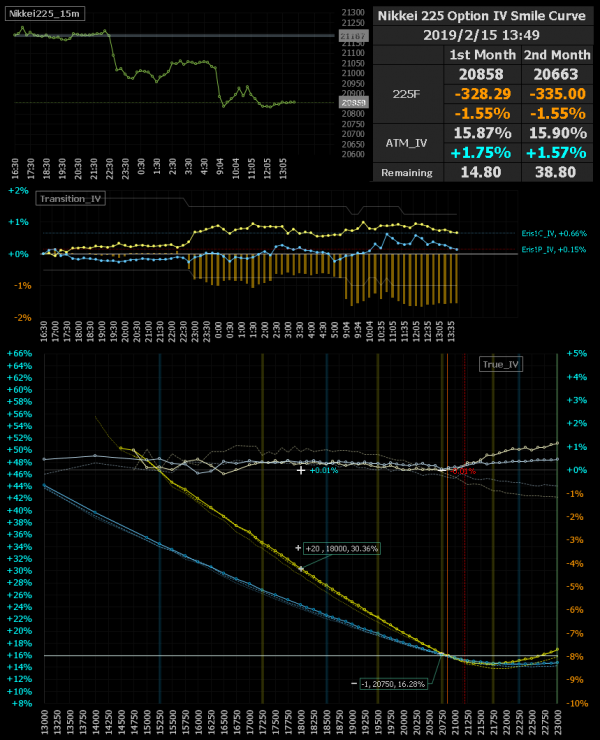

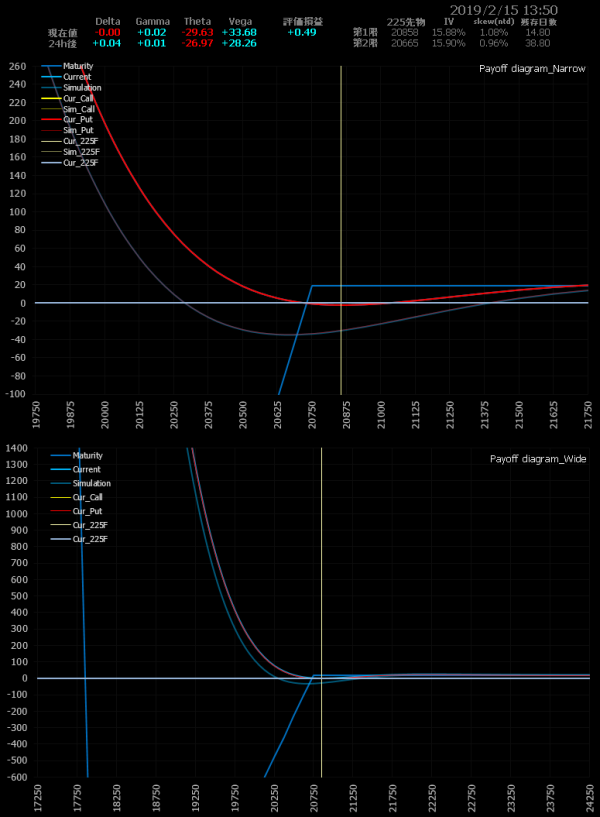

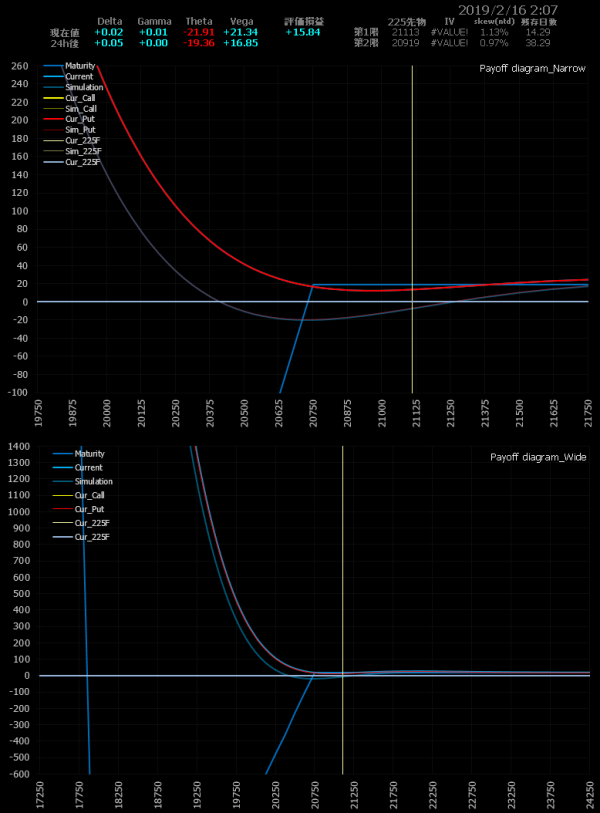

2019.02.15(金)13:50 プット・バック・スプレッド エントリー

東京市場午後。昨晩のNYタイムに21000台から叩き落された日経先物。本日は21000台で寄り付き天井。今のところ安値圏で推移している。

先物が昨日高値21200円超から400円ほど下落していることでOTMコールが盛る展開。プットは微盛りだが無反応に近い。

完璧な条件が揃っているとは言えないが、半ば強引に「プット・バック・スプレッド」をエントリー。バック・スプレッド三連発。

プットは未だ反応薄いが、今晩のNYタイムは三連休前で「壁がー非常事態宣言がー景気減速懸念再燃がー中国貿易交渉がー」とネガティブに反応するようであれば、三連休を控えてここからプットは大盛りとなるのではないだろうか。もちろんプット・バック・スプレッドは先物の上昇にも強いので、むしろNSに再び21000円回復の流れとなるのがポジションにとっては現実的な最良シナリオとなるだろう。上げてWIN、下げてWIN、ヨコヨコLOSE。三対二の法則。ギルドの訓え。

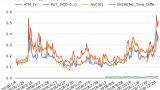

それにしてもRVの急上昇にIVが追従して来ないのはどういうことだろうか、気になる。

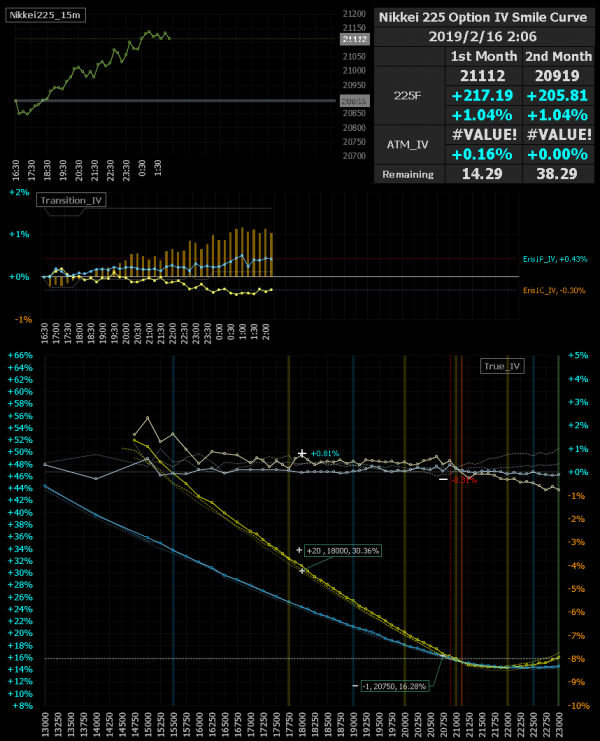

2019.02.16(土)02:05 NY市場ランチタイム経過

NSの日経先物は堅調に推移。先ほどトランプ大統領は予定通り非常事態宣言を発動した。

「上げのP盛りC剥げ」で思惑通りの「プット・バック・スプレッド」WIN……のはずなのだが、なにこのATM21000周りの「凸スマイル」。丁度ココを売っているので、コール剥げに引きずられて落ちてくれないと美しくWINとはならないのだが……。三連休前の米市場も今日はここまでだろうか。NY午後に一段高しそうなパターンではあるがポジションの返済体勢に入ろう。

ちなみに今回は一つ読みを外している。今回の「上げのP盛りC剥げ」は、単にIVの「スライド効果」であり米国市場三連休を意識してプットが盛っている訳ではない。ここは完全にハズした。

IVの「スライド効果」はスマイルカーブで観察できる。ボラティリティ・トレードを行う上で重要なことなので、この特性を覚えておくと使える。例えば「フルヘッジ・ベア・シンセティック」は「プット買い+コール売り+ミニ買い」を組み合わせたデルタ・ニュートラルのスプレッドで「上げのP盛りC剥げ」を、「フルヘッジ・ブル・シンセティック」は「プット売り+コール買い+ミニ売り」を組み合わせた同じくデルタ・ニュートラルのスプレッドで「下げのP剥げC盛り」を、それぞれ利用したスプレッドだ。

このスプレッドを分解すると、前者は「プロテクティブ・プット+カバード・コール」、後者は「カバード・プット+プロテクティブ・コール」となる。いずれも「スライド効果」を意識してタイミングを計った上でポジションを取らなければ、利益は出ないだろう。このことは本レポートで今まで繰り返し書いてきたので、いい加減に聞き飽きたかもしれない。

「スライド効果」をイメージした簡単な動画を用意したので参考にしていただきたい。

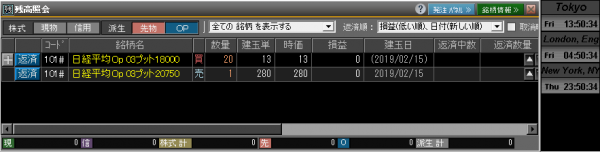

2019.02.16(土)04:30 全返済

全返済完了。買玉を投げた後に売玉を走らせ、何とかプラスで返せてよかった。今更ながら「プット・バック・スプレッド」WINの良さげなスマイルになってきたが、強引なポジション取りはイカンですね、猛反省。もっと慎重に狙っていかなければ。

1903P20750 @-1qty 280.00 JPY -> close 150.00 JPY (+130,000 JPY)

1903P18000 @+20qty 13.00 JPY -> close 8.00 JPY (-100,000 JPY)

This profit and loss +30,000 JPY

Total profit and loss +30,000 JPY