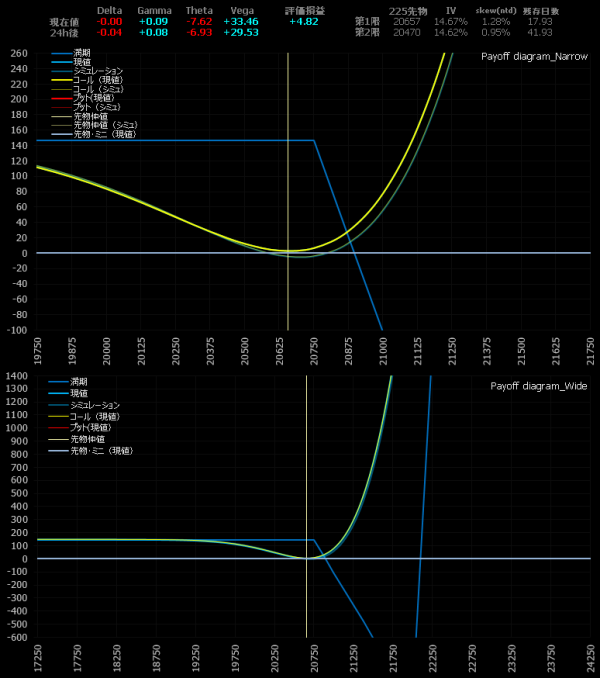

2019.02.12(火)10:40 コール・バック・スプレッド エントリー

三連休明けの東京市場はロケットスタート。週末からマーケット環境が改善したことを受けて、寄り付きは買戻し優勢の展開。為替は110円を回復し、110円50銭まで戻している。

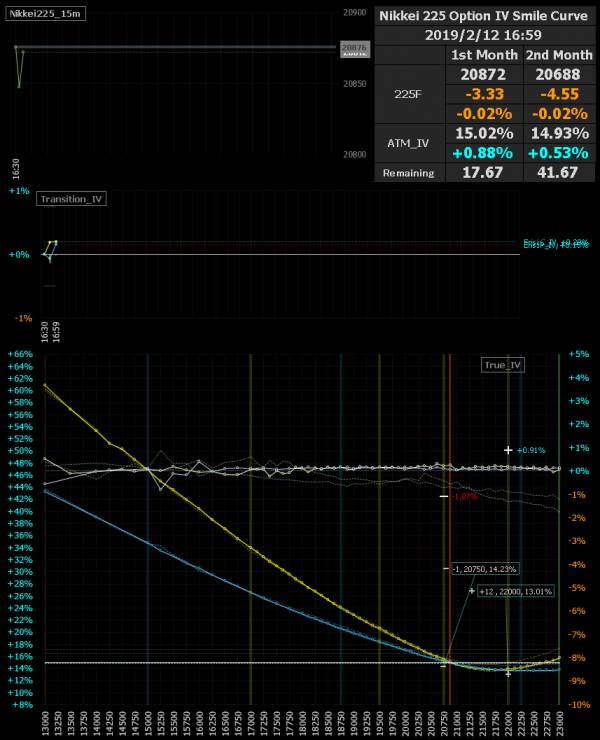

三連休が明けてマーケット警戒感が和らぎオプションは投げ売り。IVはコールOTMを中心に「ドッスン」2%ほど落ちて全剥げ。

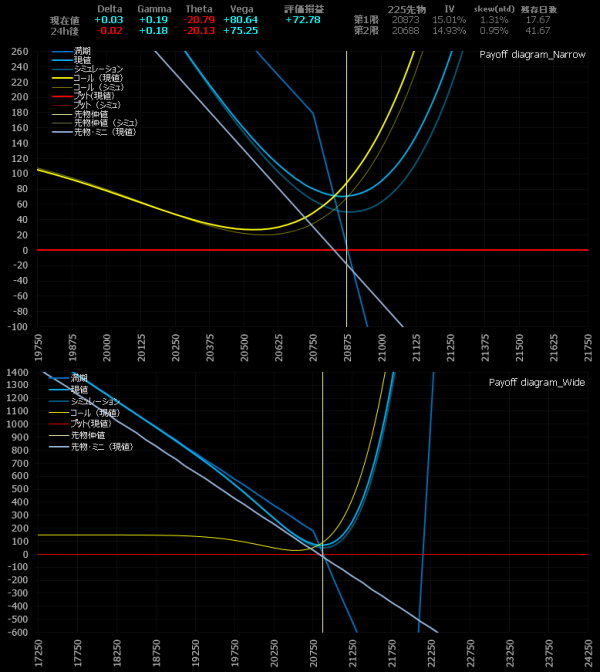

「コール・バック・スプレッド」をエントリー。三連休明けの剝げからの盛り返しを狙います。コールの寝たskewの立ち上がりを取りにいくということ。

「コール・バック・スプレッド」は、いつものアレ、「プロテクティブ・コール」の兄弟スプレッドだ。この兄弟スプレッドは、もっと評価されても良いのではないかと常々思っている。地味すぎるからだろうか非常に優秀なスプレッドにも関わらず、どういう訳か活用する人がほとんどいないのが現状。何とももったいない。ギルド集会所の参加者さまはどんどん使っていこう。レッツトライ。

「プロテクティブ・コール」の「ミニ売り」レッグが、「コール・バック・スプレッド」では「ATMコール売り」になっていることで合成グリークスはマイルドになる。兄「プロテクティブ・コール」は攻撃的で、弟「コール・バック・スプレッド」は兄よりかは温厚。兄か弟どちらをチョイスするかは、その時のスマイルカーブの状況による。優位性が高いと思われる方で組めばよい。

「プロテクティブ・コール」は今まで散々やってきたスプレッドなので、「コール・バック・スプレッド」についても特に付け加える解説もない。スプレッドを組むタイミングや注意点などは基本的には同じなので、興味があれば以下の過去記事あたりを参考にしていただければと思う。

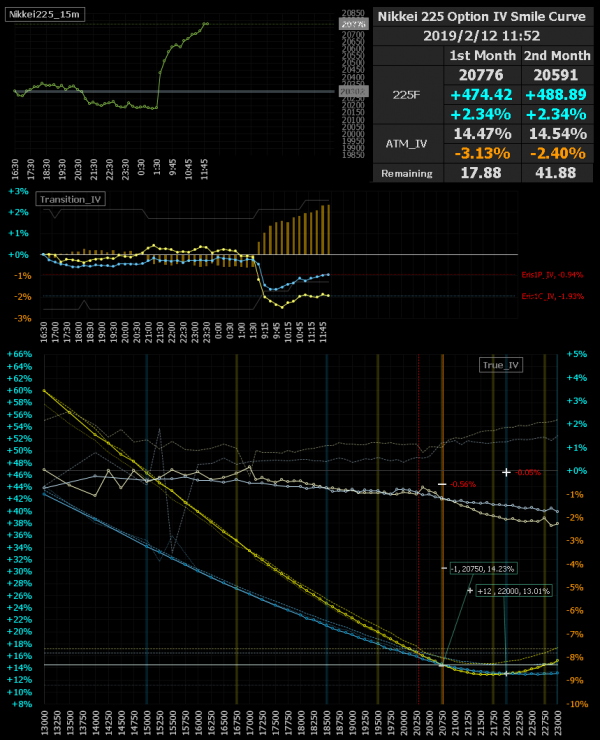

2019.02.12(火)11:50 デルタ調整

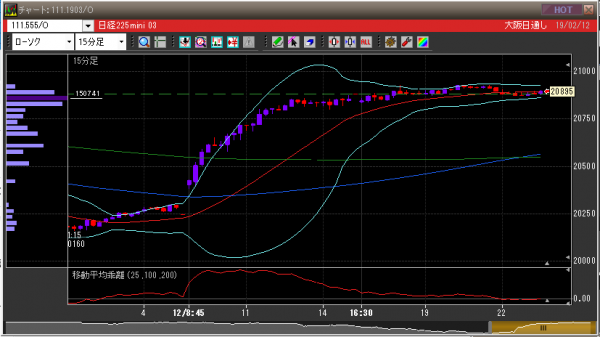

ランチタイムに500円高する日経先物。

「デルタ調整」のミニ売りを追加。コールの売玉がITMしたが、本レポートで組まれる全てのバック・スプレッドは、売りレッグがATMを中心としたNTM~ITM。元々ITMすることが前提で組まれているので、仮にDITMしても問題は起きない。

もし返すときに流動性がない場合は「プット・コール・パリティのエスケープ」で対応できる。と、教科書には書かれていない、ギルドの訓え。バック・スプレッドはおかしなストライクで組まないように気を付けよう。

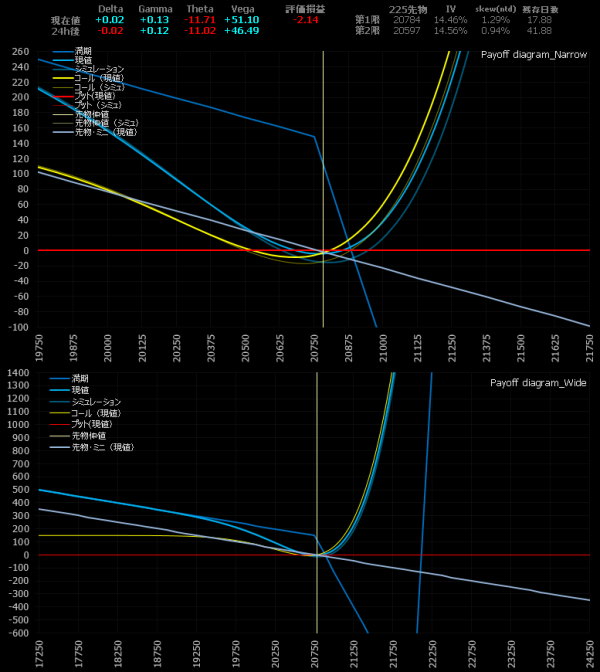

2019.02.12(火)13:45 デルタ調整

日経先物は午後に一段高。コール・プット共にIVはジワジワ盛り返してくる展開。

思惑通りにIVが盛り返してきたことでデルタがロングに傾く。先と同様にミニ売りを追加しデルタ調整。

「デルタ調整」は「単純にデルタがロングかショートに傾いたらミニを当てる」といったものではなく、「ギルドの訓え」的にちょっとしたコツがある。コツを押さえた「デルタ調整」をすることでスプレッドがクリティカルヒットした際に、ポジション評価を劇的に向上させることができる。

コツなどと言っても大げさなものではなく、やり方はパターン化しており機械的なものとなっているので、過去記事を参考にしていただければすぐにわかると思う。

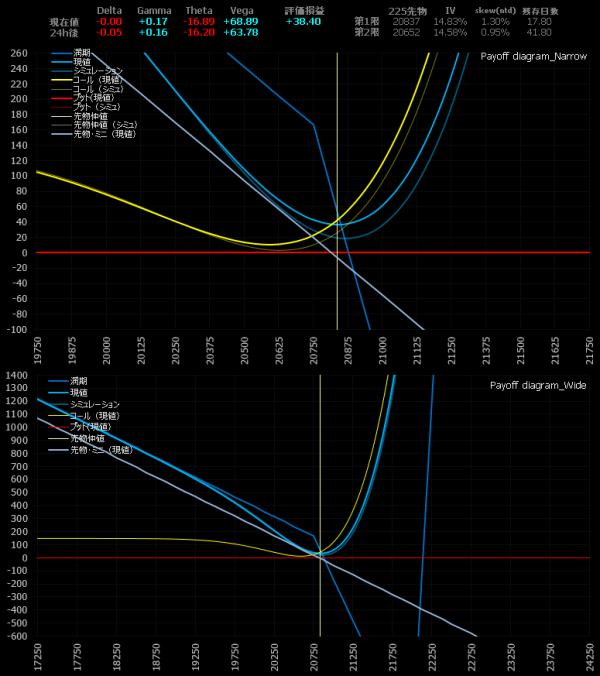

2019.02.12(火)17:00 欧州市場オープン デルタ調整

欧州市場がオープン。東京タイムの午後から先物は小動きなのだが、IVは盛り推移。

先物は動いていないがIVは盛り推移なことから、コール・バック・スプレッドのデルタが再びロングに傾く。機械的にミニ売りを当てて「デルタ調整」を行う。

先に「プロテクティブ・コール」と「コール・バック・スプレッド」は兄弟スプレッド、と書いたが、デルタ・ヘッジのミニ売りを当てた時点で両スプレッドはフュージョンし、より強いポジションとなった。どういうことか分かるだろうか。

2019.02.12(火)23:40 NY市場オープン経過

今のところ日経先物もIVも小動き。

ポジションは「コール・バック・スプレッド」をホールド。NYオープンの様子を見て返済予定。

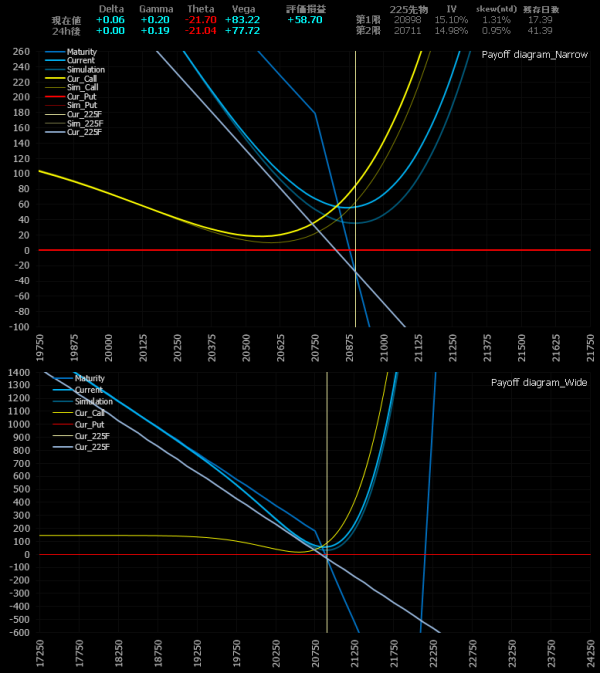

2019.02.13(水)00:15 全返済

今日のNY市場はもみ合いになりそう。これ以上コールskewは立ちそうもない。このポジションはここまでのようだ。全返済。

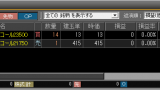

1903C22000 @+12qty 11.00 JPY -> close 31.00 JPY (+240,000 JPY)

1903C20750 @-1qty 280.00 JPY -> close 430.00 JPY (-150,000 JPY)

1903M @-4qty 20770.00 JPY -> close 20900.00 (-29,000 JPY)

This profit and loss +61,000 JPY

Total profit and loss +61,000 JPY