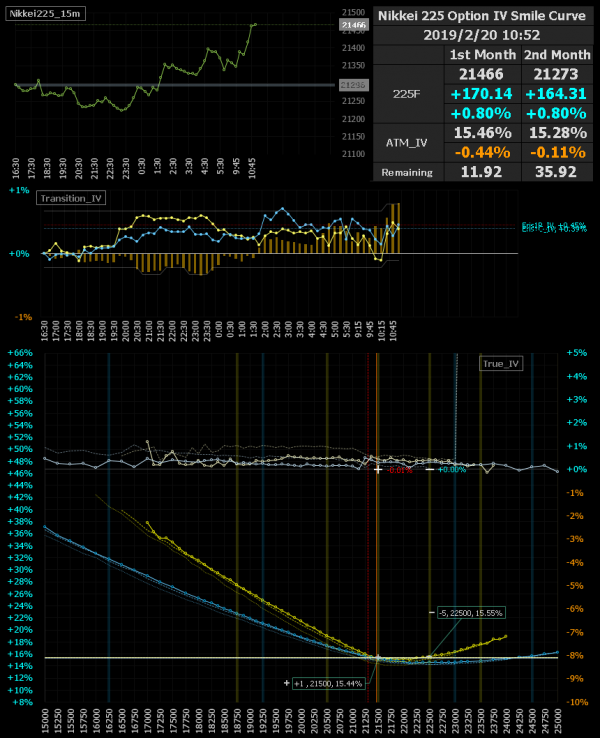

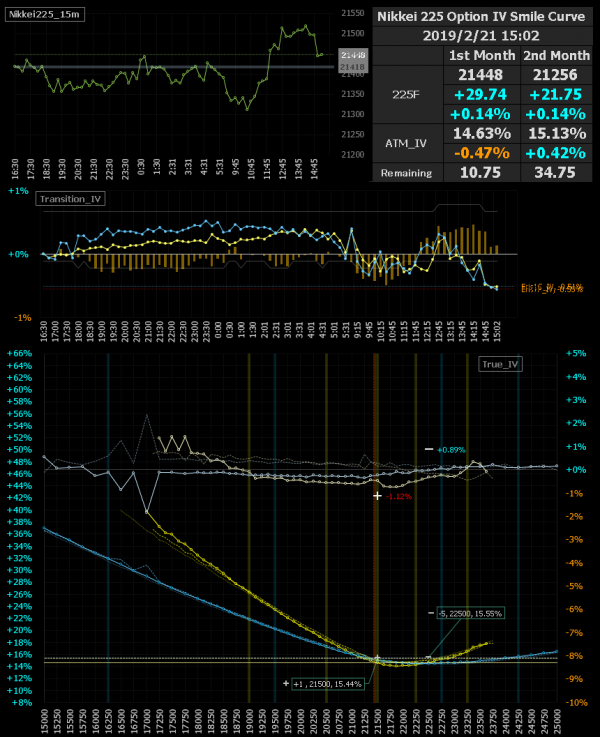

2019.02.20(水)10:50東京市場午前 コール・レシオ・スプレッド

日経平均は直近高値を更新し堅調に推移。

IVはコールが盛り出す展開。

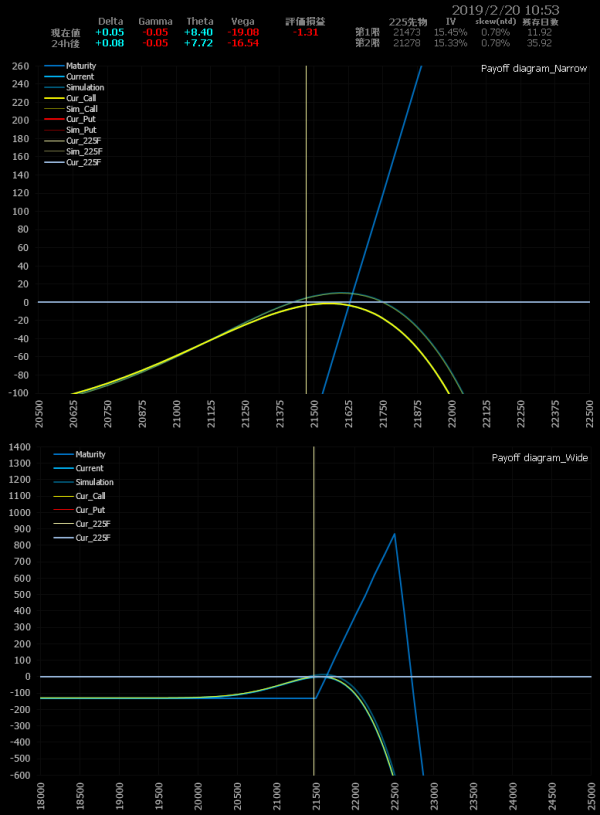

恐らく本レポート初であろう「コール・レシオ・スプレッド」をエントリー。今日の先物上昇で急騰したOTMコールをショートし、ATMコールをロング。

レシオ・スプレッドはガンマ・ベガショートの「高勝率・低ペイオフレシオ」のスプレッドで、典型的な「ザ・即死ポジション」と言える。マーケットクローズ中に現れた「ブラックスワン」には華麗に散るしかないが、せめて場中くらいは「即逃げ姿勢」を取りつつ厳重にマーケットを監視していた方が身のためだろう。プライスアラームは必須だ。

「コールで組んだレシオは安全」などと謎なことを言う人もいるが、プットとコールは表裏一体なので、どちらで組まれたレシオ・スプレッドでも危険度は合成グリークスが示す通り。必ず自分で合成グリークスを確認し、取っているリスクの大きさを理解しておこう。

しつこいと思うかもしれないが、「高勝率」の魅惑に惑わされコイツで吹き飛ぶ人があまりにも多すぎる。インターネットの僻地辺境まで本レポートを読みに来ていただいている戦友同志殿だけは、絶対にそうなってほしくない。

ブラック・スワンはいつか必ず姿を現す。

「ガンマ・ベガショート、ダメ、絶対」とオプション売りを忌み嫌うトレーダーも多いが、好き嫌いは置いといてわたしは中立的なスタンスで臨んでいる。その時々の相場に合わせて最適であろうスプレッドを変幻自在に組んでいくのがオプション取引と考えているからだ。「オプションは売りだろう、買いだろう」という何度も繰り返されてきたチープな議論のように、そこに画一的な答えを求めても意味がない。好き嫌いは置いといて、オプションを売るときは売るし、買うときは買う。

「レシオ・スプレッド」は「バック・スプレッド」の逆符号のポジションとなる。「レシオ・スプレッド」の勝ちは「バック・スプレッド」の負けだ。よって「レシオ・スプレッド」のポジション取りのタイミングは、「バック・スプレッド」を組むと負ける相場条件のときにエントリーすれば良い。

ポジション取りのタイミングは、以下のレポート辺りから回遊していただくのが良いと思う。

上でレシオ・スプレッドはガンマ・ベガショートの「高勝率・低ペイオフレシオ」のスプレッドと書いている通り、タイムディケイを味方につけているので、多少タイミングがずれていても「いずれ何とかなる場合も多い」のも特徴だ。「ザ・即死ポジション」と言われようとも、優秀なスプレッドの一つであることには疑う余地もないので、TPOをわきまえて使っていこう。

ちなみに以下のレポートで、”「コール・バック・スプレッド」は、いつものアレ「プロテクティブ・コール」の兄弟スプレッドだ”、と書いている。

勘の良い人は既に気が付いていると思うが、今回のポジションである「コール・レシオ・スプレッド」は、「カバード・コール」の兄弟スプレッドだ。「コール・レシオ・スプレッド」のコール買レッグが、ミニ買になったタイプが「カバード・コール」であり、合成グリークスはデルタ合わせで比較した場合「コール・レシオ・スプレッド」の方がマイルド。兄「カバード・コール」は攻撃的で、弟「コール・レシオ・スプレッド」は兄よりかは温厚ということ。カタカナが多すぎて自分でも訳が分からなくなってきた。

「プロテクティブ&バック兄弟」VS「カバード&レシオ兄弟」の戦いは永遠に続く。お互い逆の符号を持つ同士であり、永久に分かり合えない。どちらも正反対の性質を備えており、負けず劣らず優秀なタッグだ。

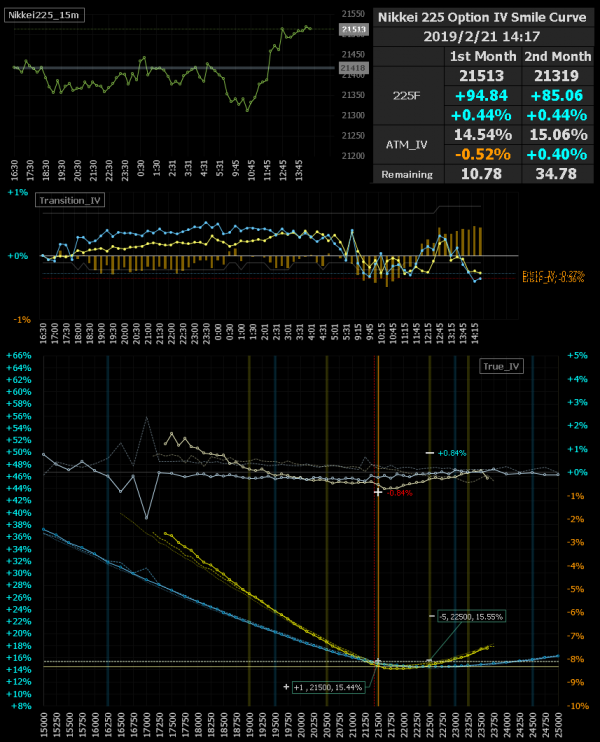

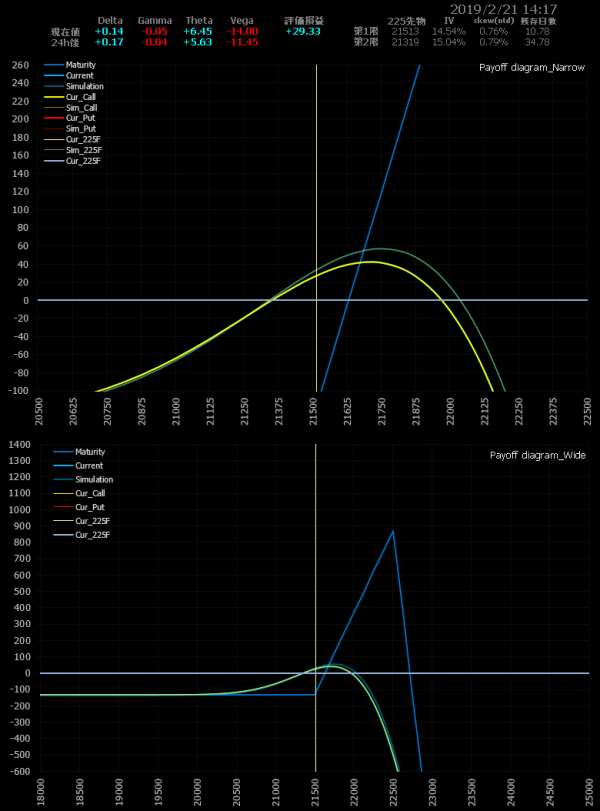

2019.02.21(木)14:15 東京市場午後 一部返済

日経先物は狭く上下しながら先ほど新高値を21550円まで更新。早朝にFOMC議事録を通過。

NTMコール剥げのFOTMプット微盛り。

ポジションは「コール・レシオ・スプレッド」をホールド。日経先物のレンジ直近高安にアラームだけ掛け、何もすることがない。放置系としてはカレンダー・スプレッドと並ぶ優秀っぷりではないだろうか。だがポジションがポジションなだけに油断は禁物だ。

マーケットに一気に楽観ムードが拡がったのか、この時間になってボラティリティは最近では珍しいくらい雑に売られ始めている。毎度の大引けスリッパ隊が来る前に買玉はさっさと返済してしまおう。この感じなら恐らく引けにかけてIVもドッサリ落ちるのではないだろうか。

2019.02.21(木)15:00 全返済

全返済完了。剥げたら仕舞、セータは無視。レシオ・スプレッドでケガをしないために必要なこと。

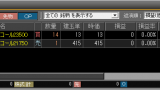

1903C22500 @-5qty 29.00 JPY -> close 17.00 JPY (+60,000 JPY)

1903C21500 @+1qty 275.00 JPY -> close 270.00 JPY (-5,000 JPY)

This profit and loss +55,000 JPY

Total profit and loss +55,000 JPY