- 2019.01.18(金)09:45 プット・カレンダー・スプレッド エントリー

- 2019.01.19(土)05:25 ミニ売りエントリー

- 2019.01.21(月)14:55 東京市場大引け経過

- 2019.01.22(火)15:00 東京市場大引け経過

- 2019.01.23(水)12:05 BOJ通過でミニ売玉追加

- 2019.01.23(水)14:40 東京市場大引け

- 2019.01.23(水)23:45 NY市場オープン ミニ売玉追加

- 2019.01.24(木)01:00 NYランチタイム経過

- 2019.01.24(木)01:10 プット・カレンダー・スプレッド返済

- 2019.01.24(木)02:15 全返済

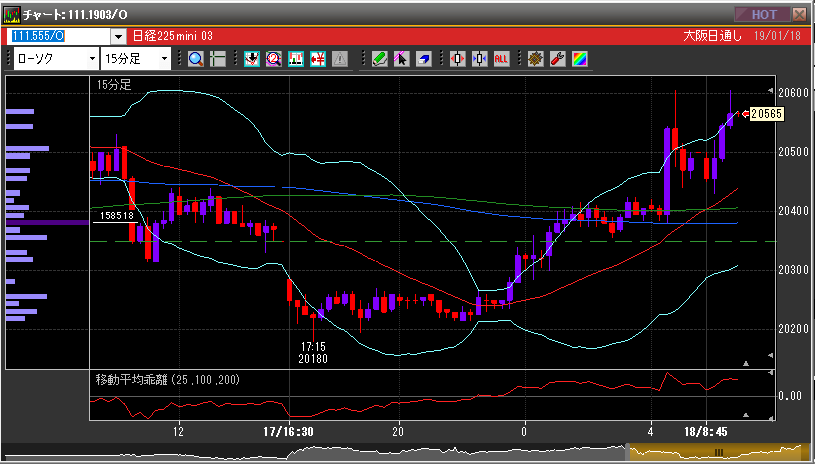

2019.01.18(金)09:45 プット・カレンダー・スプレッド エントリー

昨晩の堅調な米株を受けて日経先物も寄り付きから堅調にスタート。毎日のように叩かれている20500円の鉄板抵抗が突破できるのか注目。

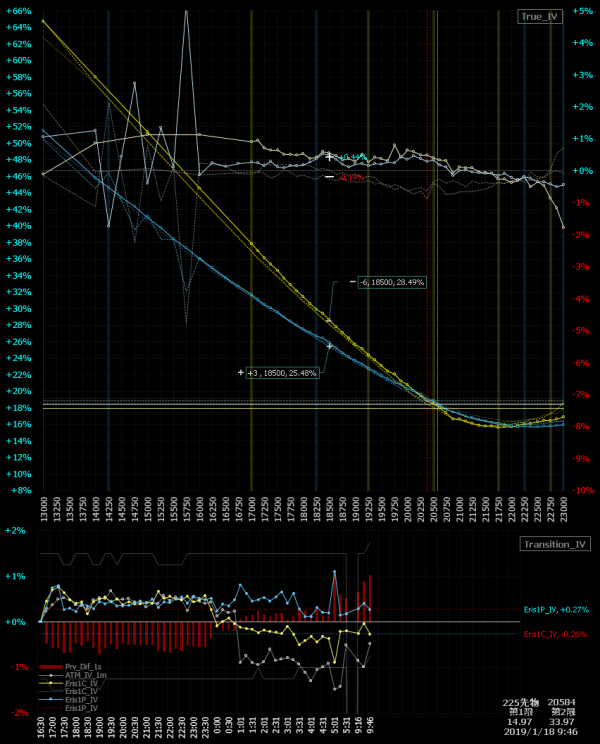

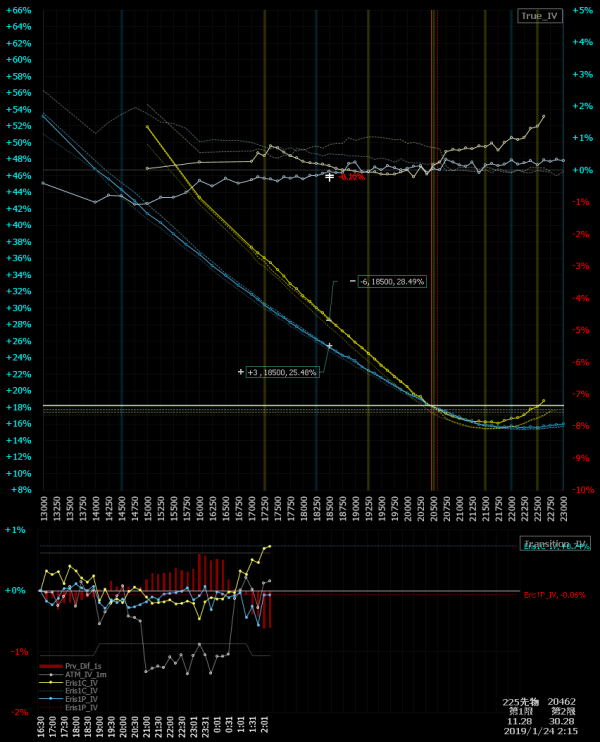

値幅はそれなりにあるのだが2日前あたりから特に動きがなくなったIV。

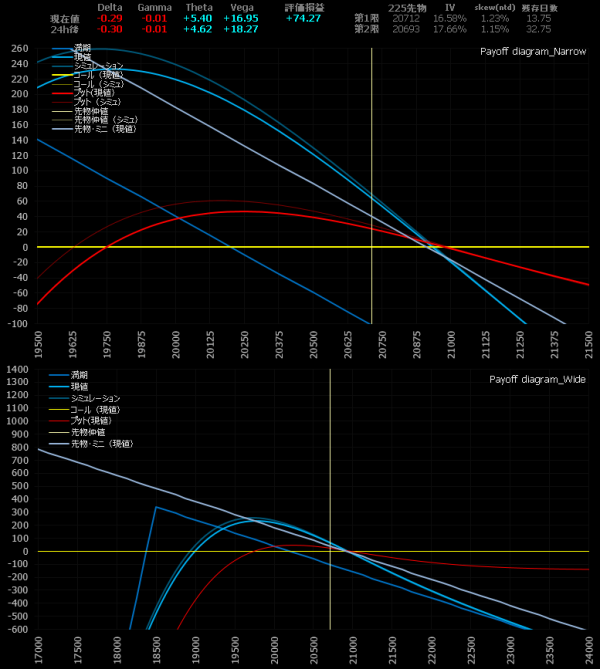

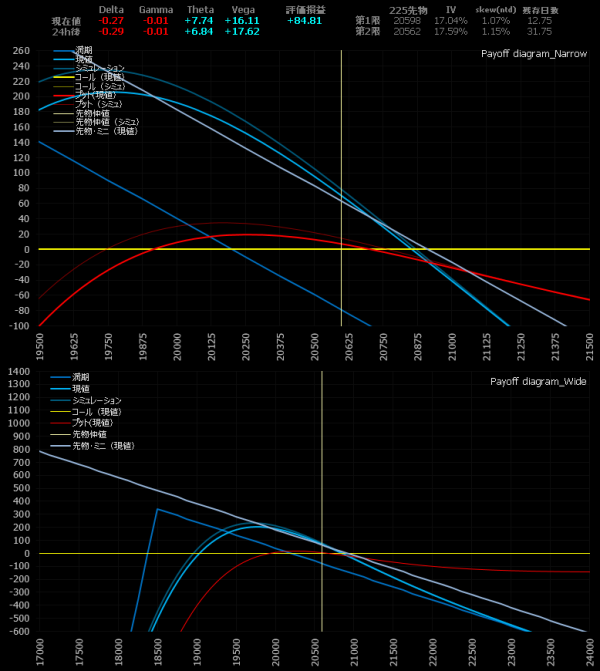

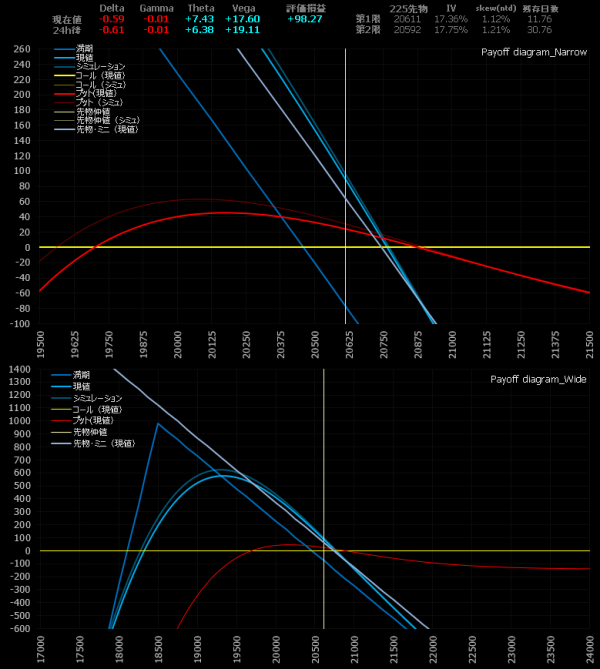

「プット・カレンダー・スプレッド」をエントリー。ここ数か月は慌ただしい相場に合わせた慌ただしいスプレッドが多かったが、今回は静かな相場に合わせて久しぶりの放置系だ。カレンダー系はグリークスがミニマムなので、今回はそこそこ長い付き合いになりそう。期近-6:期先+3なので正確には「変則」プット・カレンダー・スプレッドとなる。

さて、カレンダー系のレポートを書くときの枕詞になりつつあるが、上の画像「ペイオフダイアグラム」に記載されているVega値をご覧いただきたい。「+10.21」のプラス値となっている。

ベガ値がプラスなのでIVの盛りは「プット・カレンダー・スプレッド」の評価損益にプラスに働く。だから暴落が起きても無問題、むしろベガ益が乗る……では全然ナイナイ(手振り)。更新が止まったブログに書いていることを信用してはいけない(だから暴落後に更新が止まるのだろうと察し)。このベガ値プラスは罠なのだ。そして「プット・カレンダー・スプレッド」は紛れもなく「即死ポジション」、ギルドの訓え、理論と実践の違い。

この件に関しては以下の過去レポートで能書きを述べているので、ご興味があれば合わせてどうぞ。

2019.01.19(土)05:25 ミニ売りエントリー

本日のNY市場は堅調に推移。NS大引けでミニ売玉をエントリー。25SMAを超えてきた21000円手前のこの辺りはそろそろ戻り天井ですね。ポジションは週末持越し。ちなみにオプショントレードでデルタを一切傾けない方もいれば、ガンガン傾けるタイプもいる。トレードスタイルも十人十色、わたしは後者のようだ。

2019.01.21(月)14:55 東京市場大引け経過

週明け月曜日のザラ場はまもなく大引け。今のところ先週末のNS引け前に着けた20930円が戻り高値となっている。プラス圏を縮小して大引けとなりそうだ。出来高は相変わらず少ないながらもそれなりに個別株の物色は進む。指数に関しては特筆すべき内容もない。本日は米市場は休場となる。

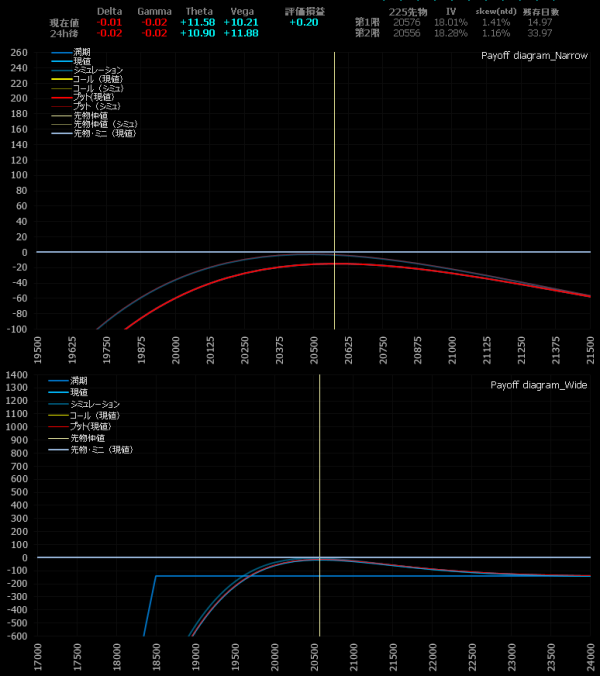

日経は先週NSの戻り高値から反落したことで、プットが地味に剥げる展開。コールは前日比トントン。

プットの剥げ方は期近>期先となっており、ここまでは「プット・カレンダー・スプレッド」にとなっては好都合な展開。米市場が休場となるNSへポジションは持越し。

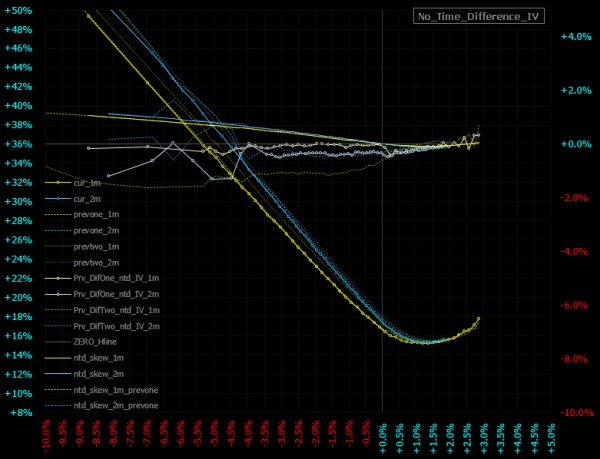

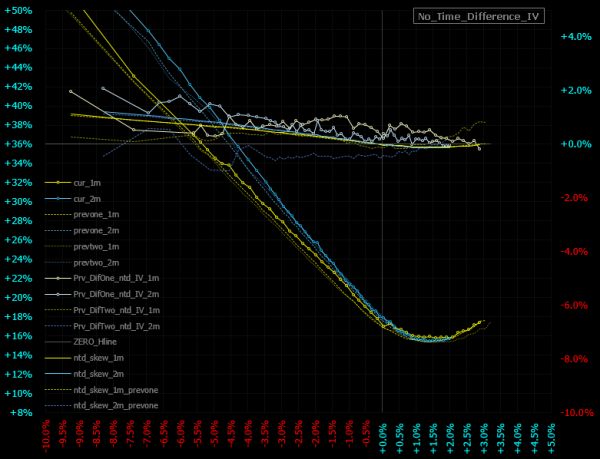

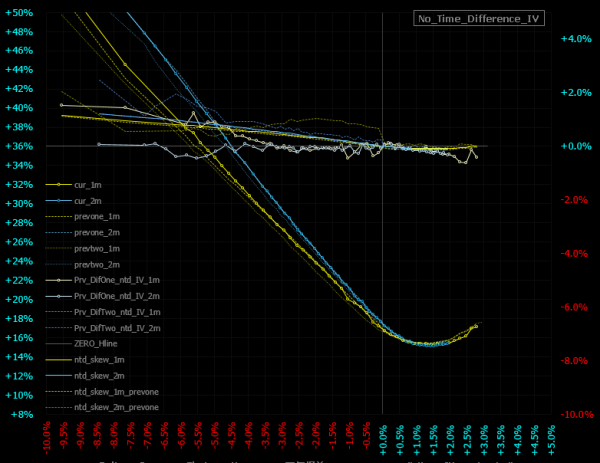

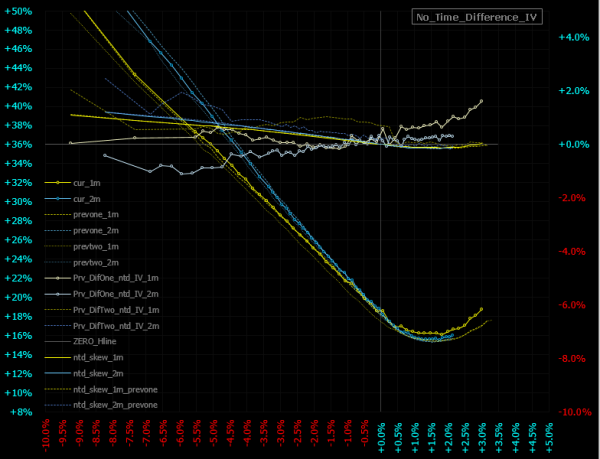

今回のポジションはカレンダー系なので「時間的影響を排除したスマイルカーブ」を掲載していく(ここまで忘れていた)。画像は本日のNS、18:20のもの。プットは期近が期先に対して大きく剥げているのがわかる。期近が割安なのか、期先が割高なのかは知らないが、いずれにせよここから読み取れるのはマーケットは目先の大きな波乱はないつもりでいるということ。そして1か月先は目先よりも楽観してはいないということ。

「時間的影響を排除したスマイルカーブ」で期近と期先がピタリ重なっている場合は、期近・期先ともに需給の偏りはなく、しばらくは安定的なマーケットだろうとマーケットは考えていることを示している。普段はあまり起きないことだが、もし期近が期先を上回っていれば、それは目先の大きな混乱を織り込んでいる状態と言える。

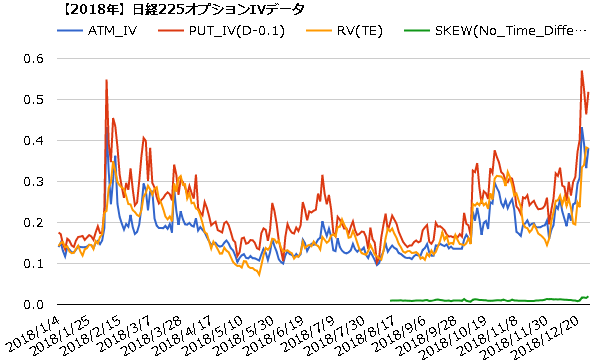

例えばこちらの昨年11月30日~12月4日のゑもんレポートでは「時間的影響を排除したスマイルカーブ」が期近が期先を上回ってきた局面だった。マーケットは目先の大きな波乱を織り込み始めた、ということ。現実にこの後のマーケットは値幅3000円を超える暴落相場に突入し19000円を割り込むまで売り込まれた。このとき先物は未だに22000円台だが、オプション市場ではこの時点で既に目先の波乱を予見していたのだ。

このように「時間的影響を排除したスマイルカーブ」を観察することは、オプション市場の「真の歪み(真のskew)」を見ていることと同意で、通常のスマイルカーブからでは抽出しずらいskewの寝立ちを際立たせることができる(通常のスマイルカーブでは時間経過でskewは勝手に立っていく)。オプション専業トレーダーの間では「孤高のゴミ指標」と名高いプットコールレシオ(どういう訳か大人は大好き)なんかより、「時間的影響を排除したスマイルカーブ」を観察した方がよっぽど参考になるのではないだろうかと、ギルドの訓え。

ちなみに「時間的影響を排除したスマイルカーブ」は「スマイルキャッチャー」に簡単に実装できる。大変ありがたいことに以下の「厳選必読本リスト」で紹介した「オプションボラティリティ売買入門(シェルダン・ネイテンバーグ)」に公式が載っているので、興味のある方はぜひ参考にしていただきたい。

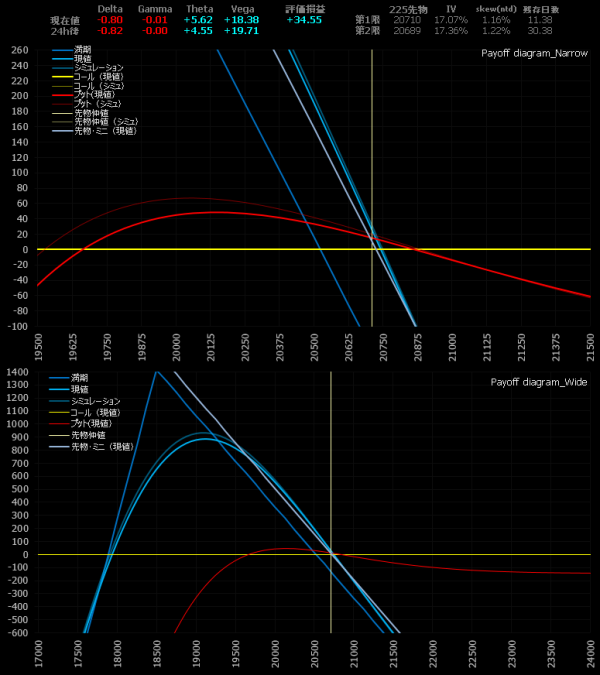

2019.01.22(火)15:00 東京市場大引け経過

米休場明けの東京市場大引け。小動き。

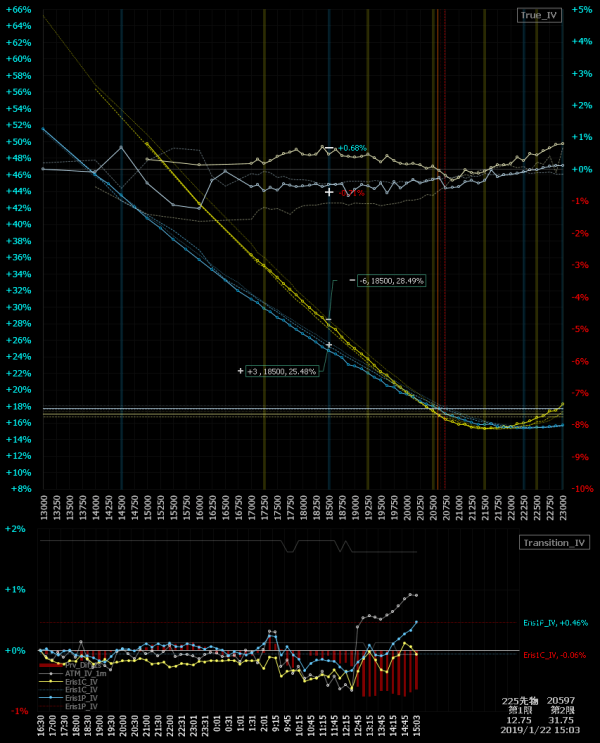

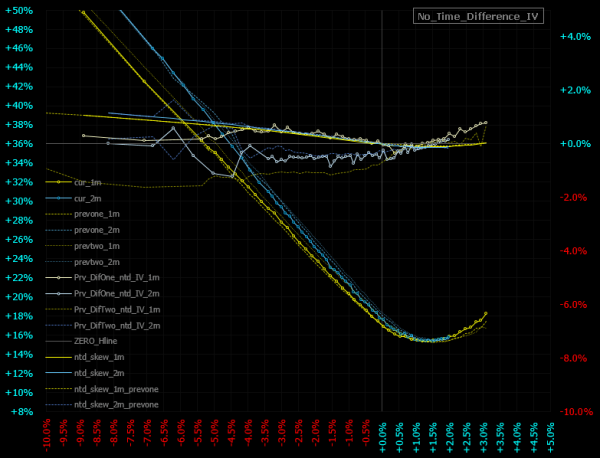

IV水準は前日比付近。限月間は期近盛り、期先剥げとなっているプット。

やはり期近盛り、期先剥げとなっているプット。

プットが期近盛り、期先剥げとなっていることでプット・カレンダー・スプレッドにとっては不利な展開。ポジションはNSに持越し。明日はBOJを控えている。

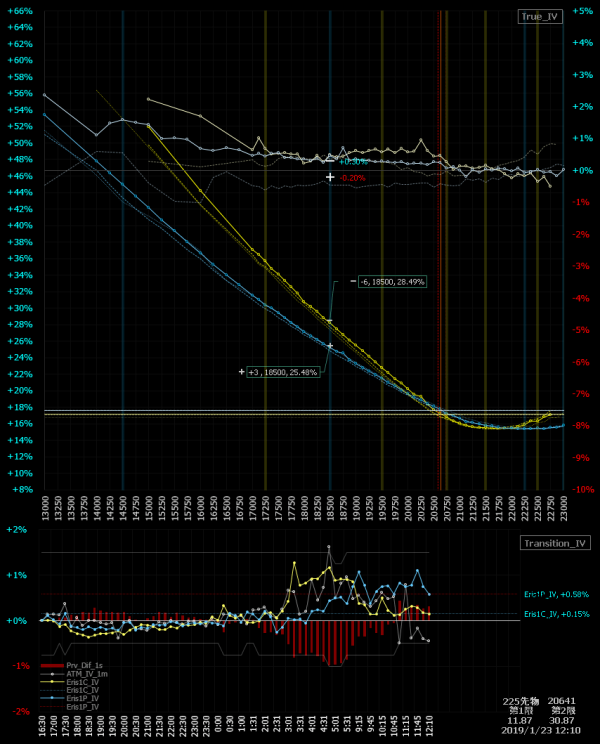

2019.01.23(水)12:05 BOJ通過でミニ売玉追加

昨晩のダウは-300ドルと5日ぶりの反落、しかし引け後のIBM決算を受けて時間外で戻す。明けて東京市場も100円程度の上窓でロケットスタート。しかしそのうち上窓も埋めに来るだろう。先ほどBOJを通過した。

BOJ通過で1903M@-3枚20628、ミニ売玉追加。先物もIVも無反応、為替は若干円安。それにしても昨晩NSの安値から+300円って相変わらず相場に中見がないですね。

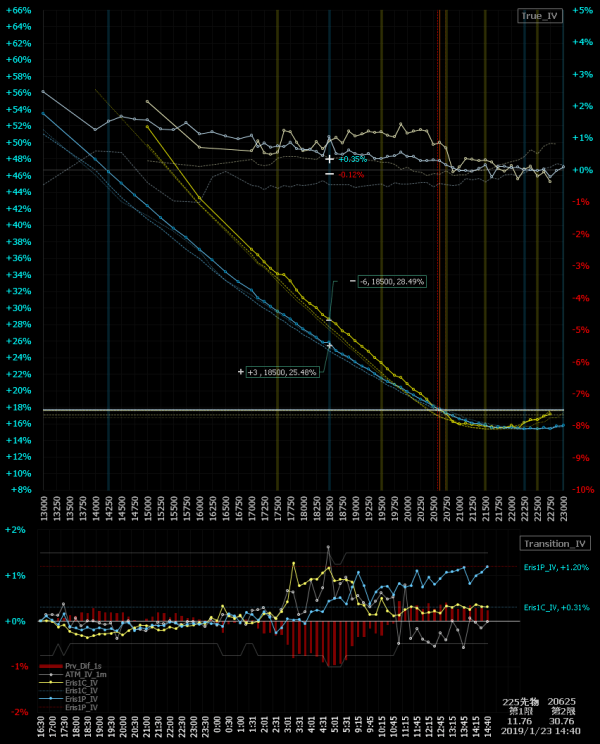

2019.01.23(水)14:40 東京市場大引け

後場、先物動かず。

後場、IV動かず。

ポジションは放置。

2019.01.23(水)23:45 NY市場オープン ミニ売玉追加

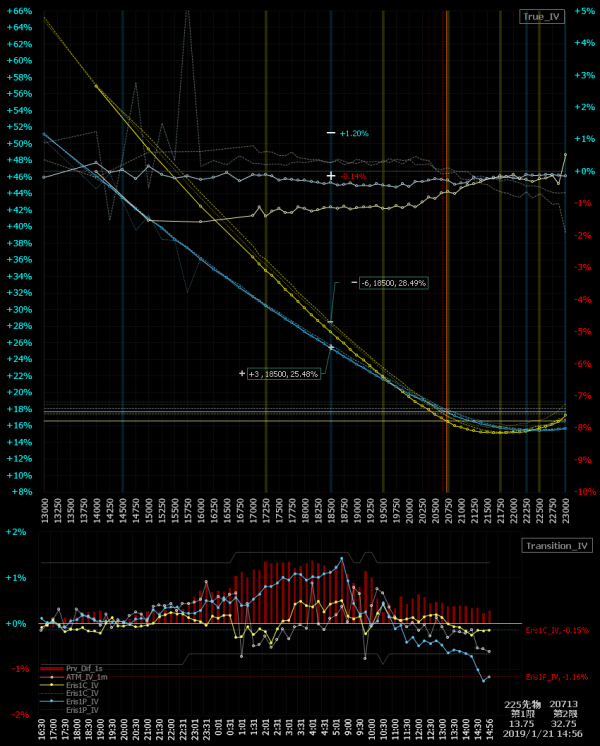

NSは寄り付き後に下押しがあったものの、ここまでウソくさく堅調に推移。ダウはおよそ+1.2%の300ドル高。

IVは特に変化はナシ。

ウソくさい上げに「レーダーが反応」しっぱなし。NY市場寄り付き後に1903M@-2枚20685、しつこくミニ売玉追加。

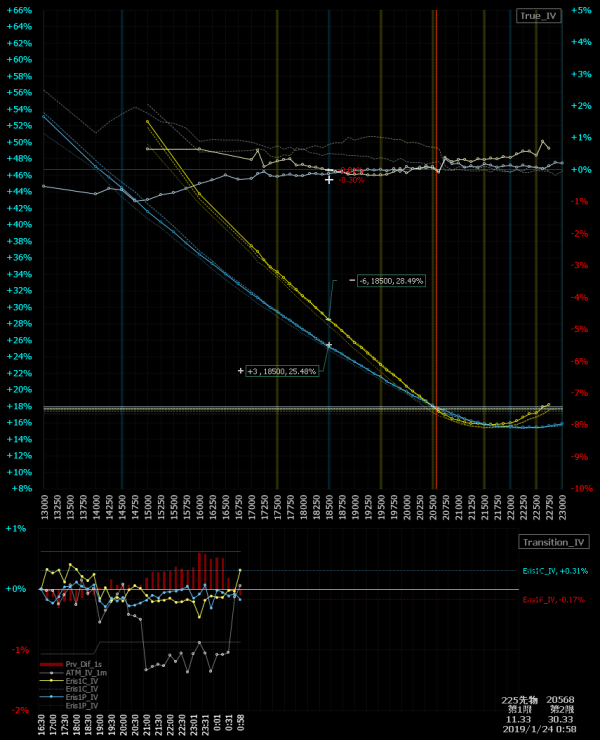

2019.01.24(木)01:00 NYランチタイム経過

この時間NY株急落。ダウはプラス圏を半分溶かした。そして人知れずVIXは21ポイント台に乗せてきた。未だ日経225オプションのスマイルカーブには怪しい兆候は現れてないのだが、VIXの21ポイント乗せは近々で何かある予兆かもしれない。そうなると「プット・カレンダー・スプレッド」を持っていてはダメだ。大体は取り越し苦労なのだが、ここは大事を取って直ぐに捨てておこう。

2019.01.24(木)01:10 プット・カレンダー・スプレッド返済

とりあえずプット・カレンダー・スプレッドは返済。結局、限月間のサヤは抜けず、セータ分しか取れなかった。それでも勝ちは勝ち。ポジションはミニ売りのみとなった。

1902P18500@-6枚40.67円 → 返済19.00円 (+130,000円)

1903P18500@+3枚128.33円 → 返済97.00円 (-94,000円)

今回の確定損益 +36,000円

合計の確定損益 +36,000円

2019.01.24(木)02:15 全返済

この時間になってダウはマイ転。日経先物は今朝の日中寄り付きの上窓を埋めたところで「セリングクライマックス」っぽく、下落一服しそうな良いタイミング。ミニ売玉も返し全玉返済完了。

1903M@-7枚20726.00円 → 20430.00円 (+207,000円)

今回の確定損益 (+207,000円)

合計の確定損益 (+243,000円)