・日経平均先物と日経平均オプション

日経平均オプションの原資産市場(または原市場)は日経平均株価です。確かにSQでは日経平均株価を基準に清算されるので、これは紛れもなく正しいことです。しかし日経平均株価が動く時間は朝の9時から15時まで、しかもランチタイムもしっかり1時間取るという所詮、一日24時間の内1/4以下の時間しか動かない指数となります。

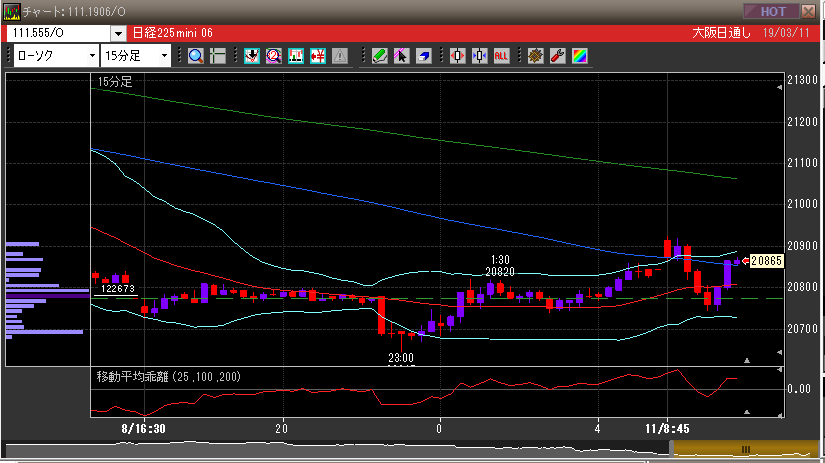

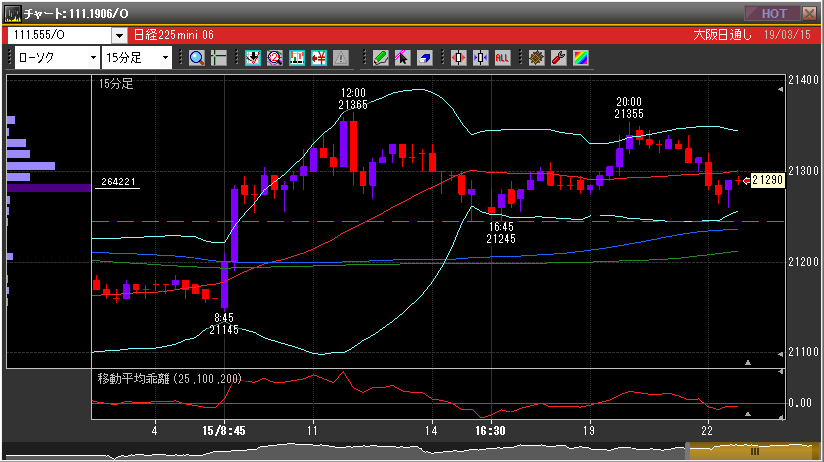

一日の大半が機能停止している原資産市場は、日経平均オプションにとって都合が悪いものです。よって日経平均株価が機能停止している夜間などは日経平均先物(またはミニ)を基準にオプション価格の値付けがされているのが現状です。

日経平均先物と日経平均オプションの取引時間は朝9時から翌朝5時30分までと、ほぼ丸一日をカバーしており、お互いに強い裁定関係にあると言えます。

・日経平均先物を買うかコールを買うかプットを売るか

ここで考えられることは、日経平均先物の動きを睨みながら、それに合わせたオプションポジションを取り、利益を上げることができる可能性です。

例えば日経平均先物が上昇すると考えるならばコールを買うかプットを売り、下落すると考えるならばプットを買うかコールを売る、といった具合です。

日経平均先物の今後の値動きを予想してオプションを取引するならば、日経平均先物そのものを売買してしまえば良いという人もいますが、パラメータがデルタしかない日経平均先物と、変化するデルタを持ちタイムディケイやボラティリティまで絡んでくるオプションとでは、そもそも全く異なるデリバティブ取引なのだから「どちらが良い」と安易に比較することはできません。

・やっぱり「オプション特性を巧みに利用してこそ」

日経平均先物の損益は、単純にポジションの持値から離れた値幅に等しくなります。一方、オプション買いの最大損失はオプション・プレミアムに等しく、オプション売りの最大利益はオプション・プレミアムに等しくなります。

要するに、「オプション買い」はどれだけポジションが逆行しても損失は限定され、順行した際の利益は限定されない代わりに、時間経過や1.0未満のデルタという非常に不利な条件を受け入れます。

「オプション売り」は時間経過や1.0未満のデルタという非常に有利な恩恵を受ける代わりに、逆行による損失は限定されず、最大利益はどれだけポジションが順行してもプレミアムに限定されます。

強烈な上昇トレンドが調整局面を迎え高騰したボラティリティが低下しているのなら、それは来たるトレンド復帰に向けて安くコール買いを仕込むチャンスとなるかもしれません。また急落でボラティリティが噴き上がっているものの下落は一時的なものと考えているのなら、それはプレミアムが乗りに乗った割高なプットを売る絶好の機会となるかもしれません。

ガンマが最大値を取るのは期近のATMのオプションでありOTMからITMしていく過程で急騰する、ベガは期先になるほど高いが変動は緩慢、セータは満期に向けて無慈悲に加速していく。このようなオプション特性を理解してうまく利用し、加えて日経平均先物の今後の値動きを考えて「利益の出る」ポジションを構築していくことは非常に重要なことになります。

やっぱり「オプション特性を巧みに利用してこそ」なのです。

・十分な結果を積み上げていくために

「日経平均先物を買うかコールを買うかプットを売るか」という問いに対する答えは、どれも違う結果となるのですから「様々な要因を踏まえその時々で最良と思われる判断をしていくしかない」、としか言えません。

オプションを単にデルタ・ニュートラル戦略としてサヤ取りすること、また上がると思うからコールを買うかプットを売る、下げると思うからコールを売るかプットを買う。こんなことはセミナー動画を見たり教科書を読めば今すぐ誰にでもできることですし、インターネットの僻地辺境まで本レポートを読みに来てくださっている読者さまは、オプション取引の表面だけを舐め取ったような薄い内容に興味はないでしょう。

例えば最も人気の高いスプレッドの一つである「プット・バック・スプレッド」。多くのセミナー動画や教科書では相場の下落で利益が出るポジションと説明されています。理論的にはそれで間違いありません。

しかし実際に「プット・バック・スプレッド」を組んで予想通りに日経平均先物が下落しても、大きな含み損を抱える結果となった経験をお持ちの方も多いと思います。素直に先物を売っておけば利益となったものの、なぜこうなるのでしょうか。「プット・バック・スプレッド」は、単に相場の下落だけでは利益は出ないのです。

同じようにある程度の下落ならカバーできると解説されている「カバード・コール」。現物や先物のロングポジションの下落をコール売りでカバーしているつもりが、実際に相場がちょっと下落しただけで両方で損失が出始め、やがてもう少し相場が下落すると盛大な「又裂き」となってしまった経験をお持ちの方もいらっしゃるでしょう。

ある程度の下落すらもカバーできないなんて、損の上塗りをしただけなので悪夢と言えます。先物の下落でコール価格が上がるとは感覚と反していますが、「カバード・コール」は単に組めばそれでカバーできるとは限らないのです。

長年のオプショントレーダーの猛者は、「プット・バック・スプレッド」も「カバード・コール」も、セミナー動画や教科書に書かれているような意図でポジションを取ることは、ほぼありません。

目標達成に向けて長期的に十分な結果を積み上げていくためには、単にアゲサゲの賭けや単なるスプレッド取引だけで終わらせず、マーケットの動向を睨みつつ上記のようにオプション特性を考え、一歩踏み込んだポジションを組んでいかなければなりません。わざわざオプション取引を目標達成の手段として使う最大の理由は、「一歩踏み込んだ先の大きな優位性」に期待しているからなのです。