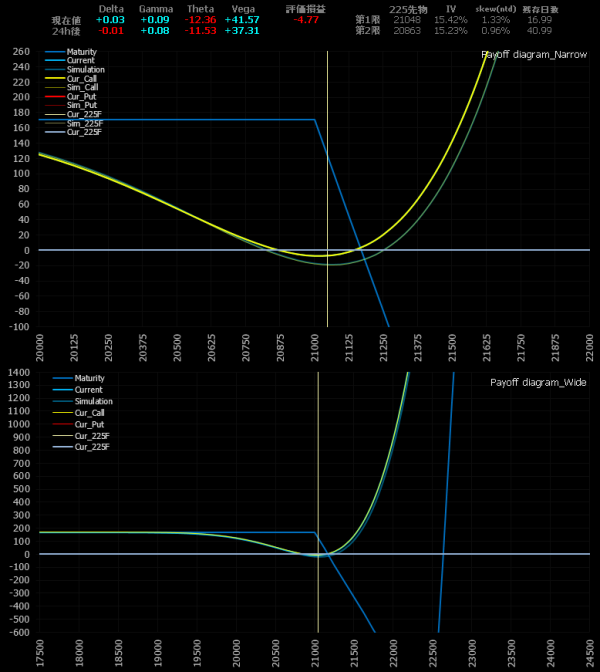

2019.02.13(水)09:15 コール・バック・スプレッド エントリー

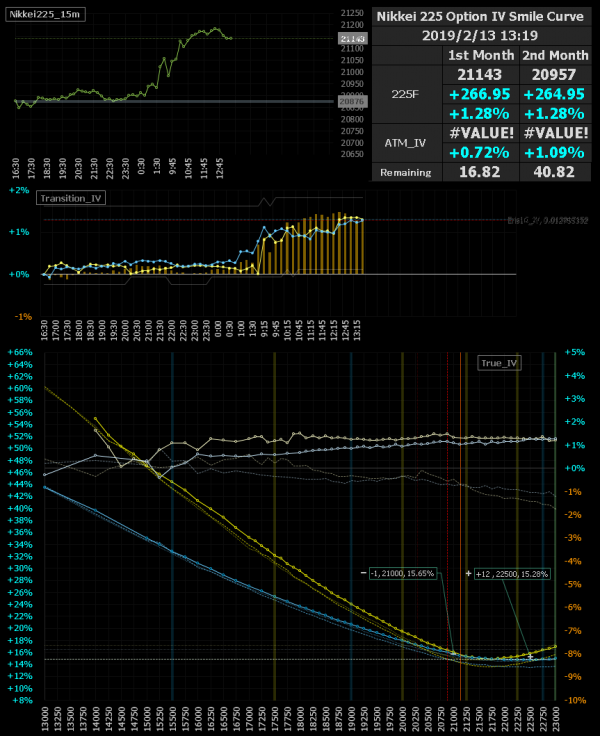

東京市場の寄り付きから21000円を回復してスタートした日経先物。IVは全盛り、特にプットが強い。

ああ、これは昨日と同じくコール・バック・スプレッドで取れそうだ。

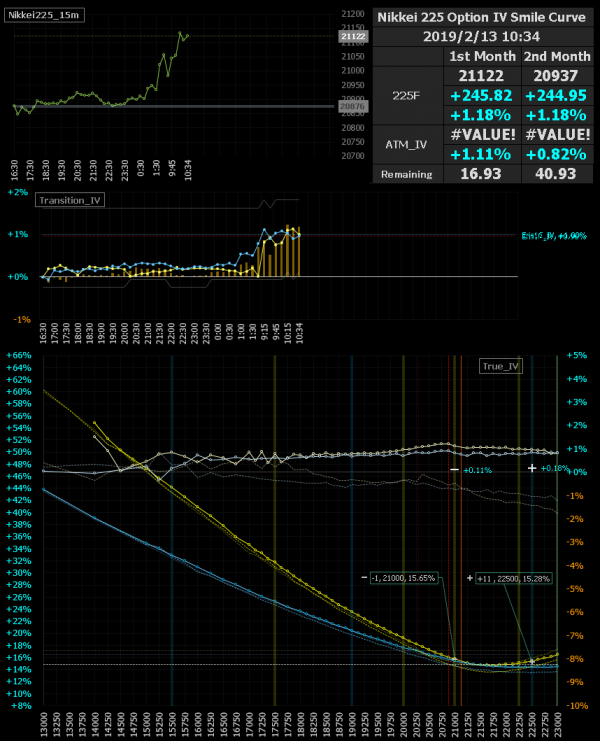

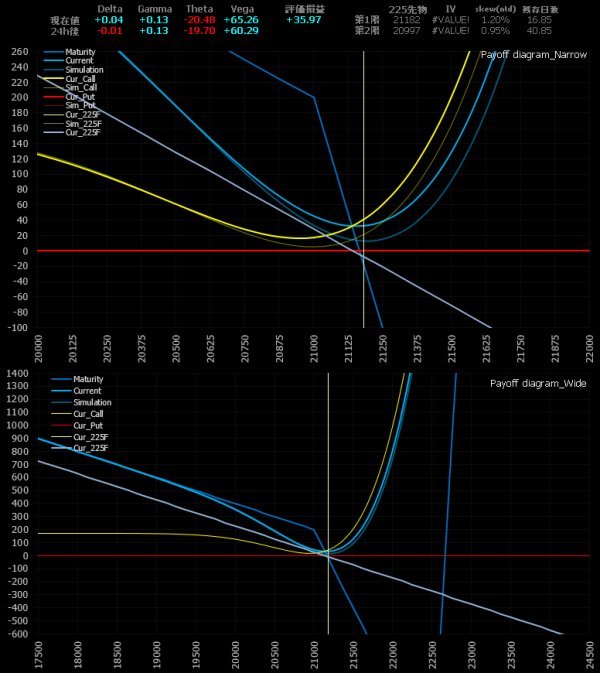

オプション取引ってスプレッドが多くて難しい、と感じている方はこう考えると良いと思う。多くのスプレッドがあるけれど、結局どれも「高いIVを売って、安いIVを買って、そのサヤ取りをしているだけ」。オプション取引とはボラティリティのトレード、そしてボラティリティ・トレードの優位性は「ボラティリティの強い回帰特性を利用する」こと。

ボラティリティの強い回帰特性を利用してサヤ取りをしようと、スマイルカーブ上で高いIVを売って安いIVを買った結果、それは○○スプレッドになった、そんな雰囲気。スプレッドありきではなく、「全てはスマイルカーブ次第」。

コール・バック・スプレッドに関する能書きは昨日のレポートで。

2019.02.13(水)10:30 デルタ調整

中国市場の寄り付きで「デルタ調整」のミニ売り。「デルタ調整」に関しても昨日のレポートで。

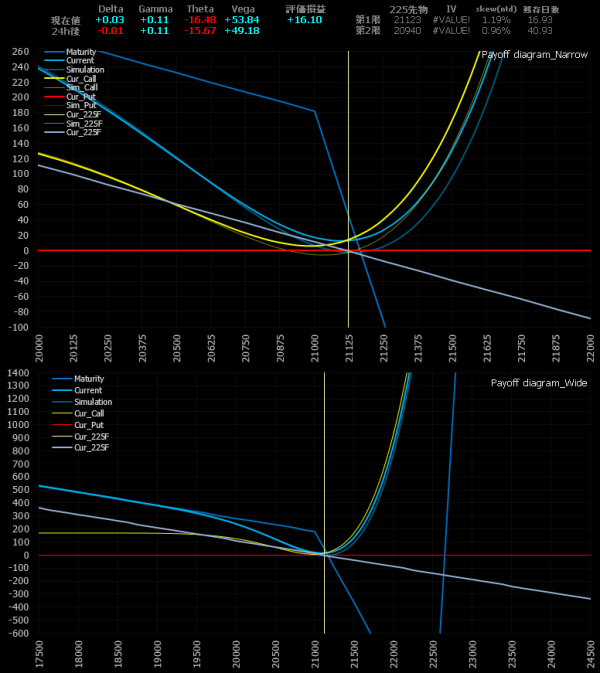

2019.02.13(水)11:40 デルタ調整

再び「デルタ調整」のミニ売り追加。画像は省略。

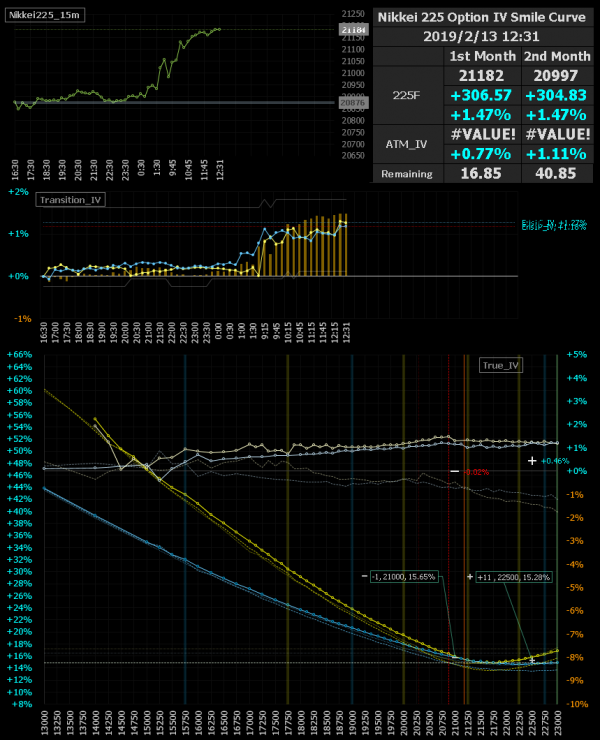

2019.02.13(水)12:30 東京市場午後 経過

日経先物は後場も堅調に推移。

IVは+1%を超えてきた。

東京市場午後、先物は垂れてきそうな雰囲気。21000円に乗せるここまで「上げ全盛り」をしてきたので、下げたら剥げるだろう。ボラティリティ・ロングのポジションは萎むのが早い。実が残っているうちに返しておこう。ポジションはまもなく返済予定。

2019.02.13(水)13:10 全返済

全返済完了。結果的にデイトレになった。次のチャンスを探そう。

1903C22500 @+12qty 18.00 JPY -> close 27.00 JPY (+108,000 JPY)

1903C21000 @-1qty 370.00JPY -> close 430.00 JPY (-60,000 JPY)

1903M @-2qty 21145.00 JPY -> close 21140.00 JPY (+1,000 JPY)

This profit and loss +49,000 JPY

Total profit and loss +49,000 JPY