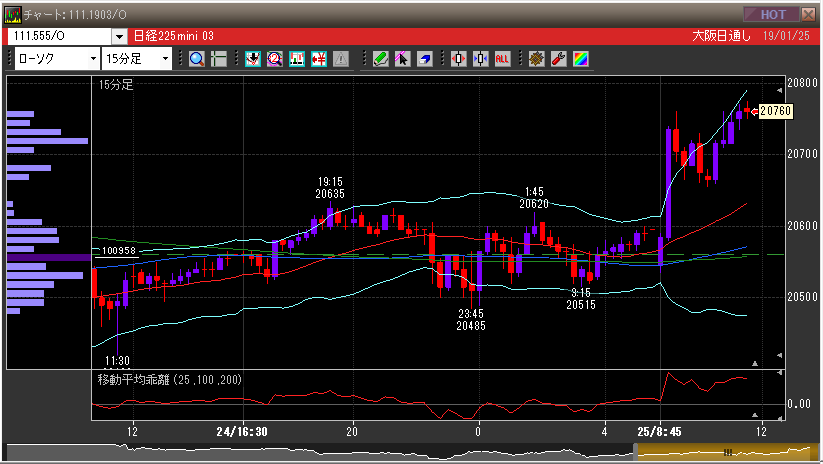

2019.01.25(金)11:40 プット・カレンダー・スプレッド エントリー東京市場ランチタイム

ダウはマイナスで返ってくるも、東京市場は謎に寄り付きロケットスタート。強弱入り混じる米決算以外は特に材料はない。相変わらず出来高少なくマーケットは冷ややかな反応。そうは言いつつ、こういうダラダラした相場はすこぶる苦手ナリ。

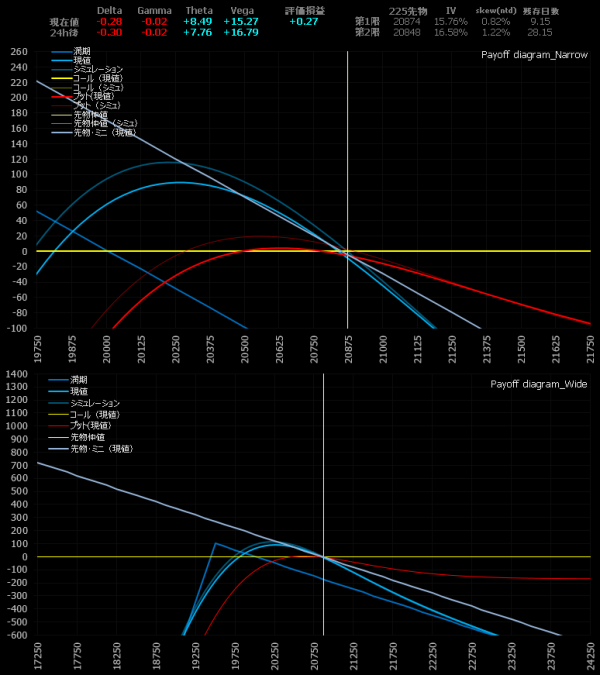

先物上昇によりOTMプットが地味に盛っている。しかしFOTMプットは剥げる展開。

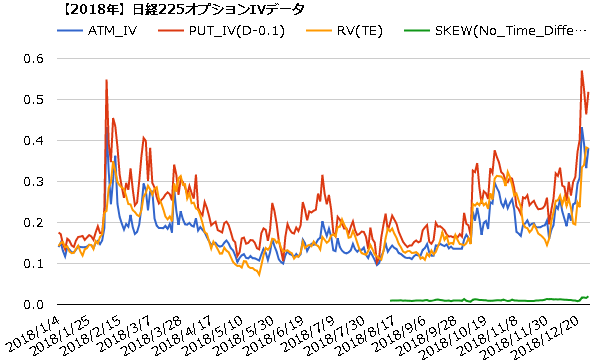

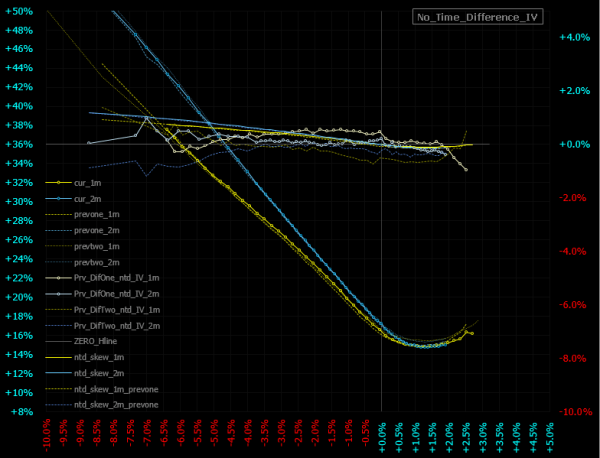

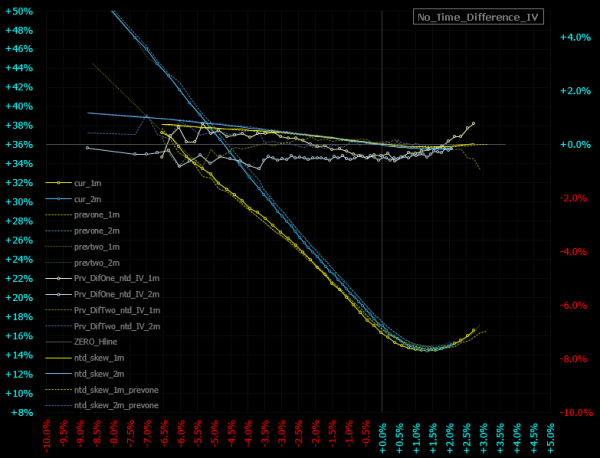

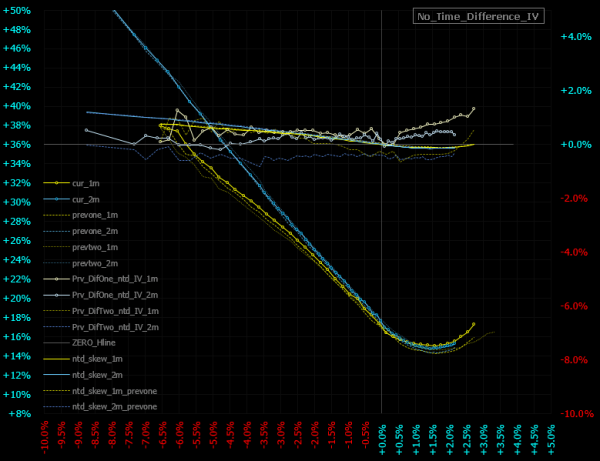

「時間的影響を排除したスマイルカーブ」。プットOTMの期近が期先にサヤ寄せしているのが確認できる。

心底やりたくないと思っているけど、この相場では仕方ない。好き嫌いではメシは食えないのだ。先物がスルスルと謎上げをしてきたとことで前回と同じく、プット・カレンダー・スプレッドをエントリー。前回のレポートでプット・カレンダー・スプレッドの注意点や罠など「ギルドの訓え」を長々と述べているので、ご興味がある方は合わせて参考にしていただければと思う。

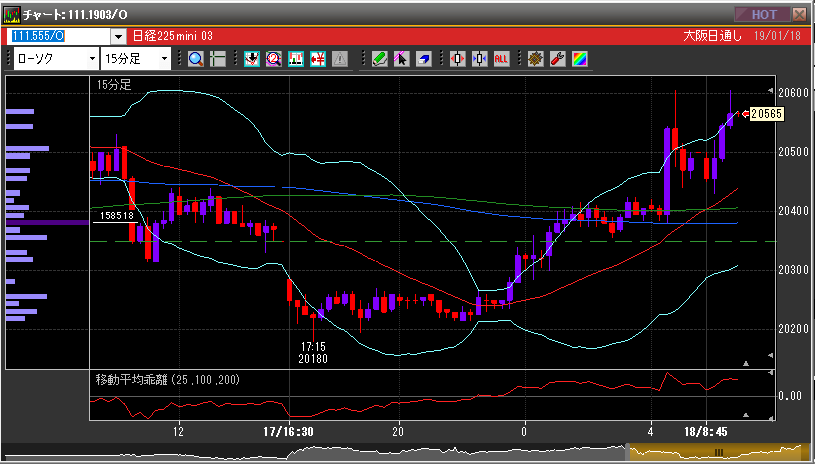

2019.01.26(土)05:20 NS大引けミニ売玉新規建

まもなくNS大引け。今日も米株はご覧の通りの堅調推移。

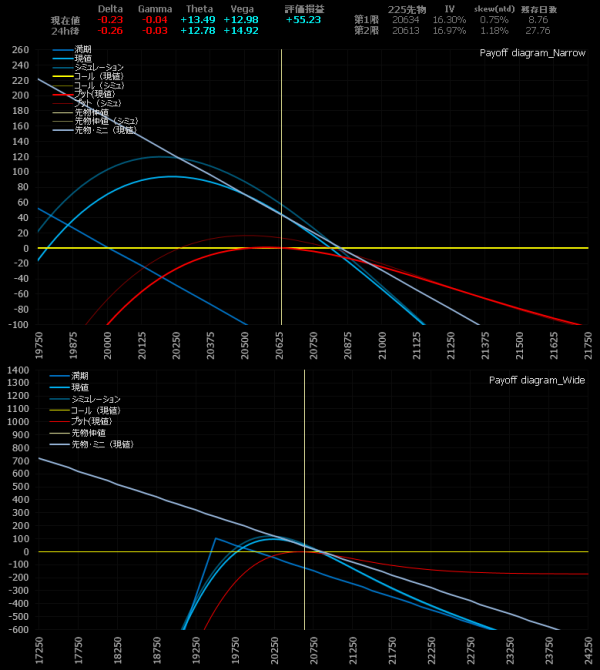

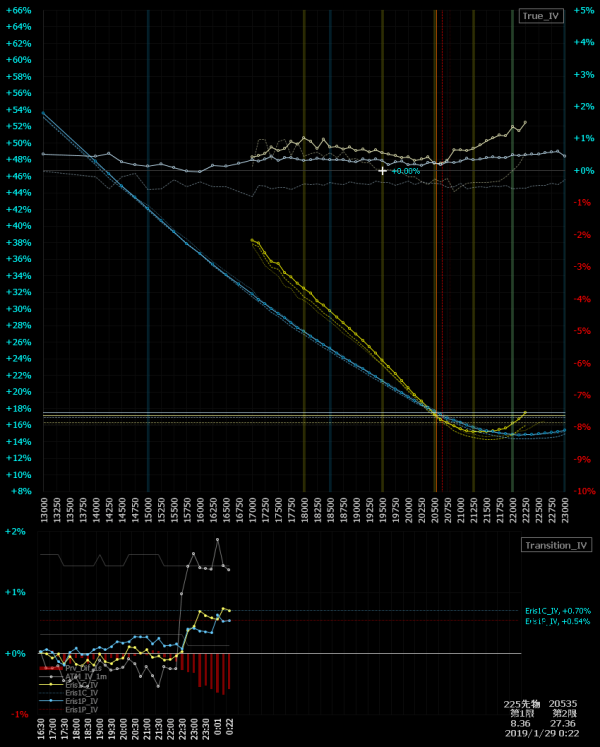

微盛りのプット。限月間のサヤは縮小、プット・カレンダー・スプレッドにとっては不利な展開。

この時間になって米政府機関閉鎖絡みで「トランプが折れる形で3週間のつなぎ予算を承認」というポジティブニュースが出た。商い薄い為替でドル買い仕掛けが入ったが、米株は反応薄でウソくさい。ミニ売玉新規建。前回レポート、先週の金曜日と全く同じ相場なので、今週も同じことします。ポジションは週末持越し。

2019.01.28(月)14:45 東京市場大引け経過

週明け月曜日の東京市場は下窓を開けて寄り付き。その後は方向感なくダラダラと推移。まもなく大引け。

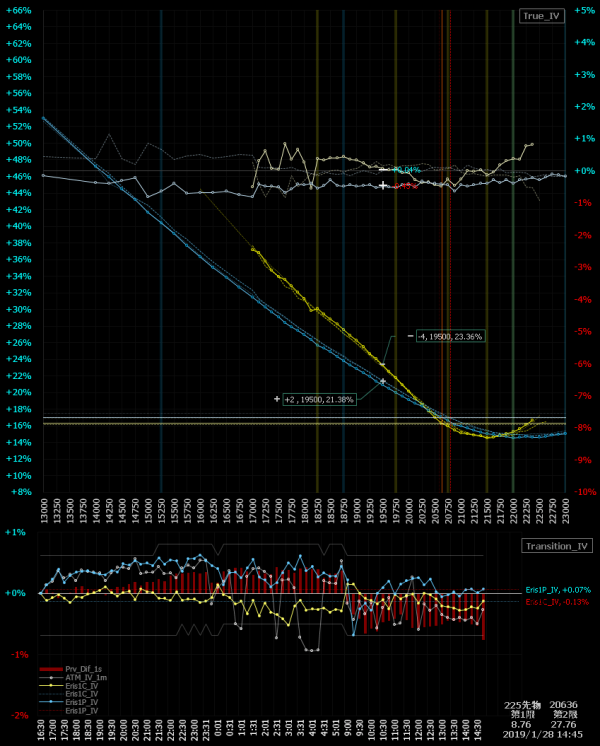

IVは小動き。素直に先物の動きと連動。

ポジションはNSに持越し。

2019.01.28(月)23:30 NY市場オープン経過

NSに一段安した日経先物。

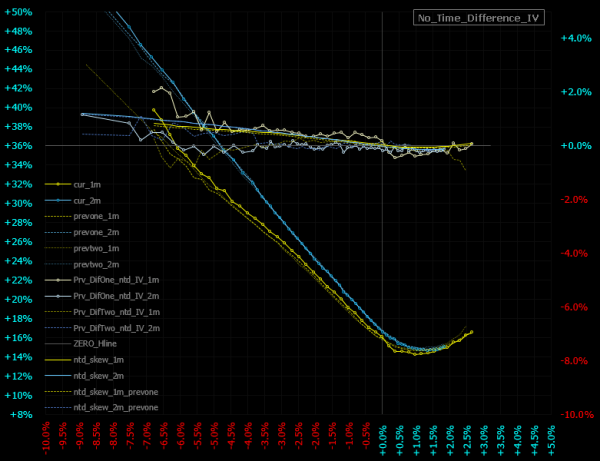

期近は微盛り、期先は変わらずのIV。「時間的影響を排除したスマイルカーブ」では期近のプットが期先にサヤ寄せし、スマイルカーブが重なりそうになっている様子が観測できる。VIXは再び20ポイント目前まで急騰している。

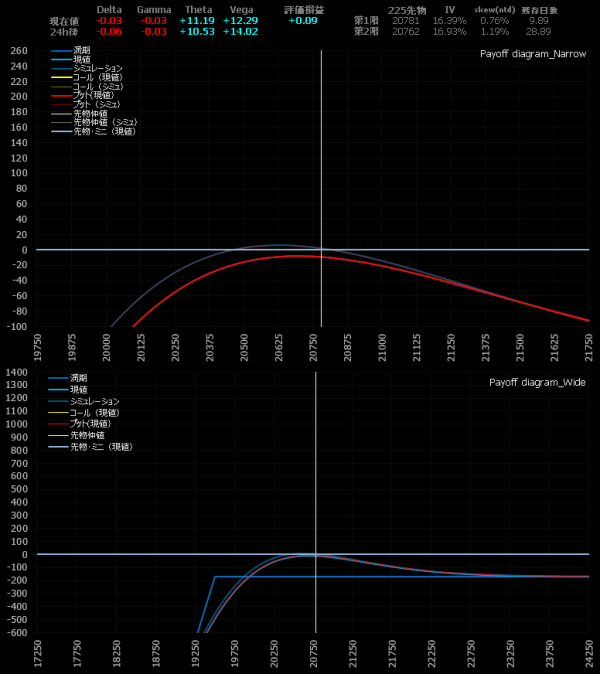

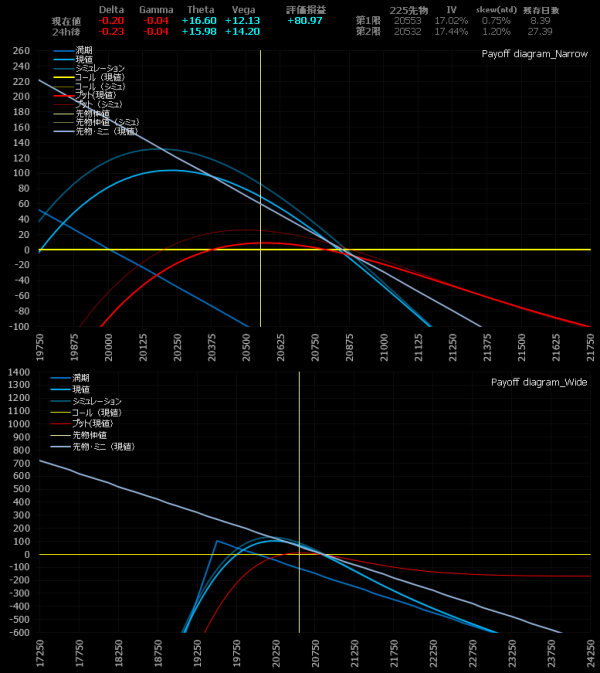

プット・カレンダー・スプレッドにとっては不利な展開が続く。ペイオフダイアグラムのプット線(赤色)では、現時点で既に利益ピークに達しているのがわかる。VIXは20ポイント目前でプット売りに恐怖を感じる。撤退のマイシグナルだ。このポジションもここまでか。

2019.01.29(火)00:10 プット・カレンダー・スプレッド返済

プット・カレンダー・スプレッドを返済。またしても取れたのはセータ分のみ。ポジションはミニ売りのみ。

1902M19500@-4枚38.00円 → 返済53.00円 (-60,000円)

1903M19500@+2枚160.00円 → 返済200.00円 (+80,000円)

今回の確定損益 +20,000円

合計の確定損益 +20,000円

2019.01.29(火)00:20 全返済

ミニ売りも返済し、全返済完了。VIXは20ポイントに乗せた。どうしてもVIXが気になって仕方がない。

1903M@-2枚20855.00円 → 返済20505.00円 (+70,000円)

今回の確定損益 +70,000円

合計の確定損益 +90,000円