今回は短いレポートとなるので「スマイルキャッチャー」のポジションシートへの入力方法を、「NFP」イベントプレイの「プット・バック・スプレッド」の「シミュレーション」と兼ねて書いていこう。「スマイルキャッチャー」でポジション管理をする際の参考にしていただければと思う。

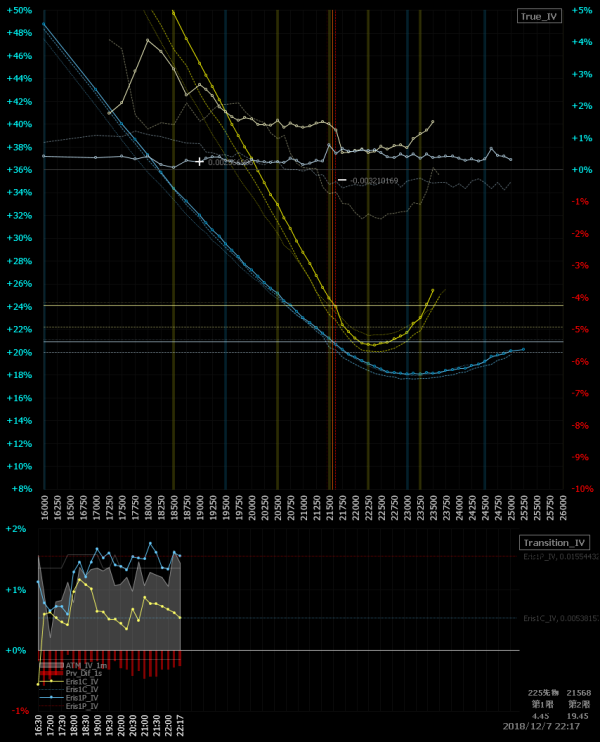

2018.12.07(金) 雇用統計前の観察

昨日はファーウェイショックということで世界中の株式市場が散々な目に合ったわけだが、昨晩の米市場がマイナス800ドルからの全戻しを演じて引けたために、本日は値幅のない落ち着いた市場が戻ってきている。嵐の前の静けさなのかもしれないけど。

さて今晩のお楽しみは22:30NFP。金曜の夜だからといってこの時間から飲み歩いている場合ではない。決して飲みに行くなという訳ではない。出かける前にスマイルカーブを観察し、もしおカネが落ちているようなら(お下品)まず飲み代を稼いでから出かけよう(オッサン)というお話なのだ。

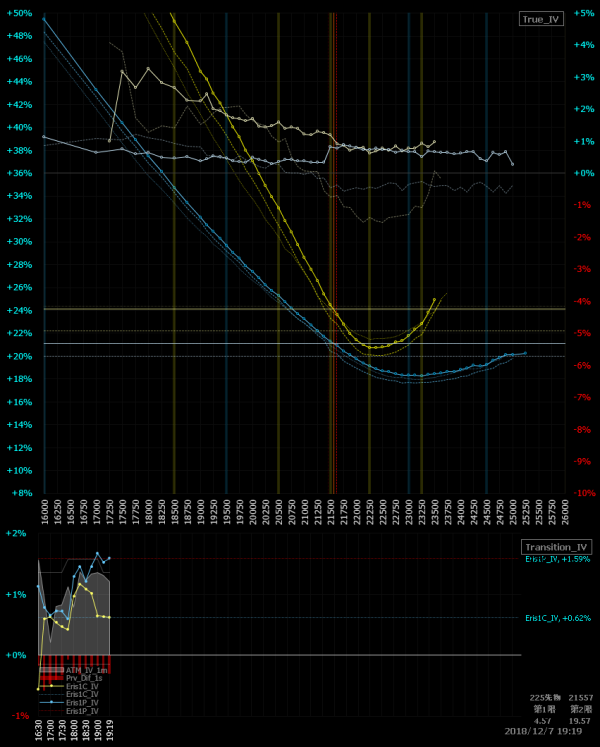

IVはというと今日のマーケットは落ち着いているので昨日特盛した分を剥げ散らかしていてもおかしくないのだが、NSはジリジリと盛ってきている。この感じ……「NFP」盛りのようだ(ニヤリ)

ニヤリとしながらもskewが既に立っているのでイベントプレイを仕掛けるには完ぺきなスマイルカーブとはお世辞にも言えない。むしろ少々微妙な感じでもあるが、何とかなりそうにも思える。まぁダメならダメで、それもお勉強になるのでとりあえずやってみよう。

ポジションはイベントプレイ時のいつものアレ、「プット・バック・スプレッド」。イベント前にスプレッドを組み、通過後に全返済する。skewの立ちを取りに行くスプレッドなのでNFPの結果はどうでも良い。

ポジション取る前にまず権利行使価格や枚数などの「シミュレーション」をしながら、もう少しマーケットの動向を観察しよう。焦ってはいけない。

以下のページから伝説の日経225オプション取引用売買支援ツール「スマイルキャッチャー」をダウンロードして起動させ、しっかりと準備しておこう(説明的文章)

「楽天証券」の「楽天マーケットスピード」と「楽天RSS」の起動も忘れずに。

20:50 プット・バック・スプレッド エントリー

「プット・バック・スプレッド」はFOTMプットの買玉の枚数が多くなる。当然ながら1円違うと×枚数分が損益に影響するので買玉は慎重に建てる必要がある。メンドクサイからといって売り板にぶつけたりはせず、買い注文を置いて辛抱強く待とう。一度に約定しないようなら既約定分にミニを当てるなりしてヘッジしていく。FOTMプットが全約定したら、売玉を建てる。

「プット・バック・スプレッド」は買玉を建てている間に相場が動かれては都合が良くないので、スプレッドを組むときはなるべく相場が静かなときが良いだろう。

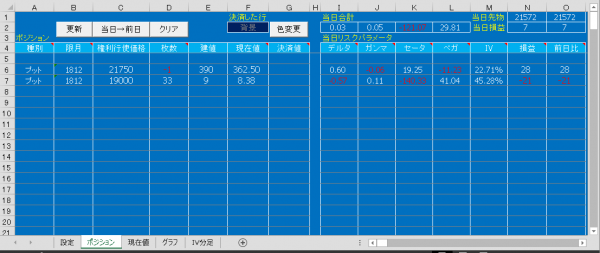

今回は、

1812P21750@-1枚 390.00円

1812P19000@+33枚 9.00円

という「プット・バック・スプレッド」を組んでみた。-1:+33のデルタ・ニュートラル。日経先物の現値は21540円なので、ITM「プット・バック・スプレッド」となる。なぜITMのプットを売ったのかは後ほどわかると思う。

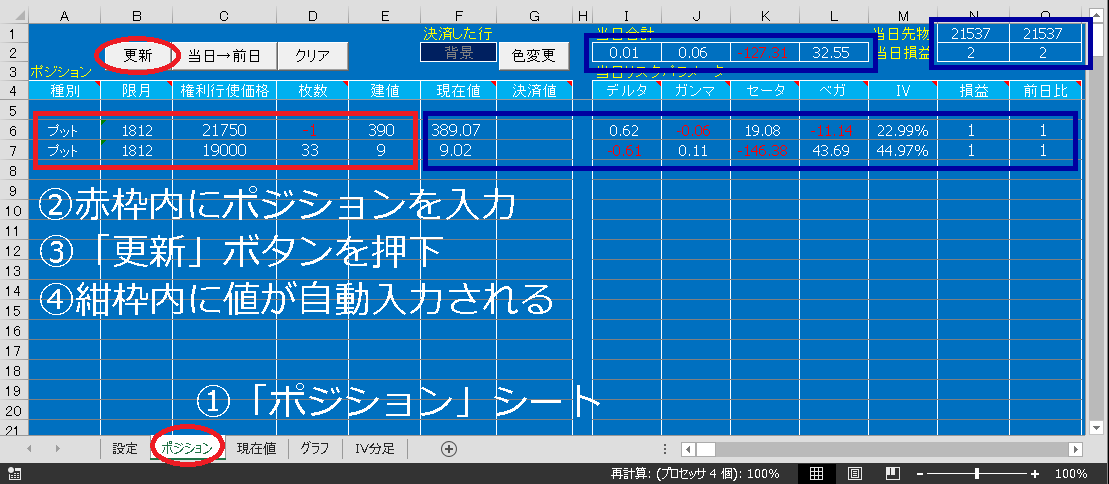

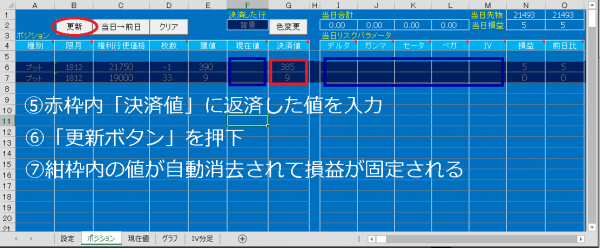

では下の画像の手順で建てたポジションを「スマイルキャッチャー」に入力していこう。

①「スマイルキャッチャー」の「ポジション」シートを開き、

②赤枠内にポジションを入力。種別は先物・ミニ・プット・コールの選択式になっている。

③入力が出来たら左上の「更新」ボタンを押下する。

④すると紺枠内にグリークスとポジション損益が自動入力される。グリークスとポジション損益はリアルタイム更新なので、値は刻々と変化しているはずだ。一喜一憂ワールドへようこそ。

入力を消去するときは該当のセルや列を選択しキーボードの「Delete」で値を消してしまっても良いし、全消去なら「クリア」ボタンを押下しても良い。

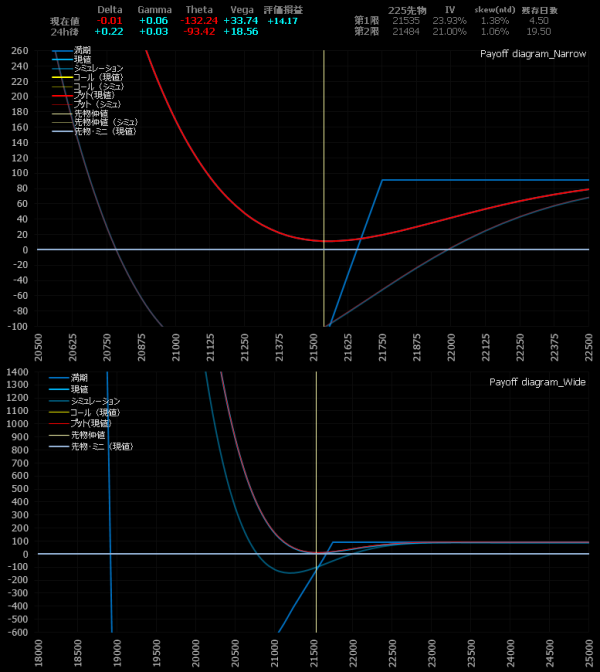

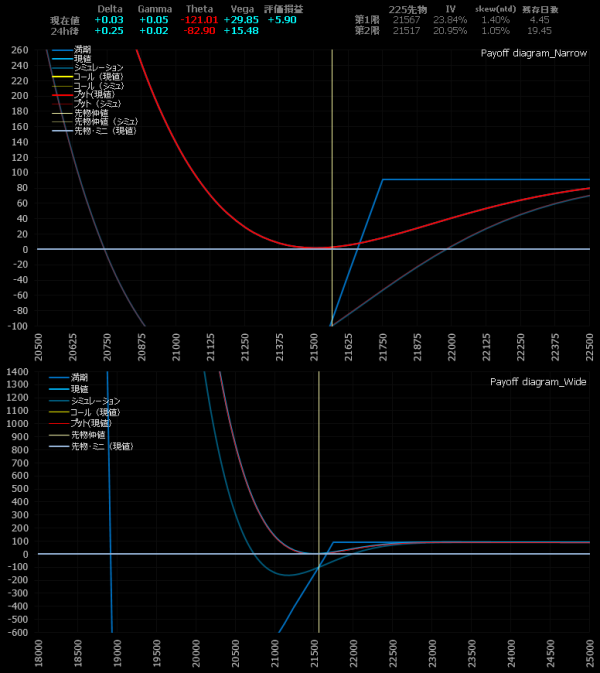

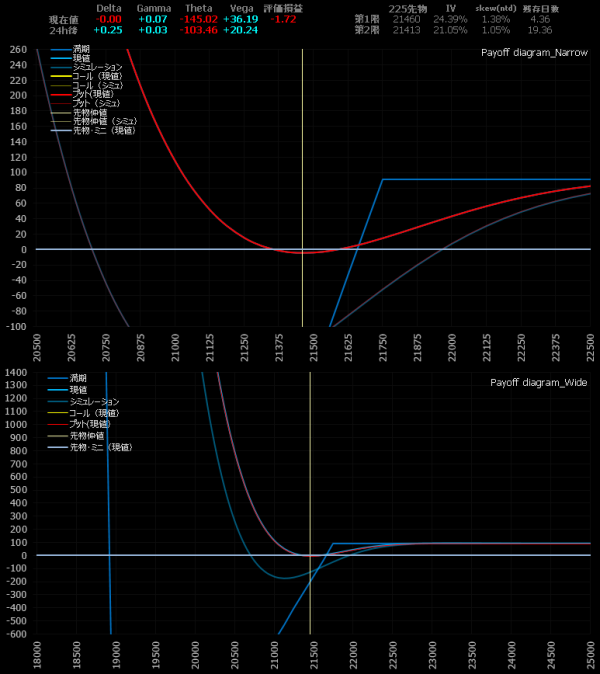

今回の「プット・バック・スプレッド」を「ペイオフダイアグラム」にするとこうなる。この画像は自分用に「スマイルキャッチャー」を改造したものだが、使いやすいよう好きにイジくれる汎用性高さも「スマイルキャッチャー」の良いところだ。

では22:30「NFP」前に着席するまでフロに入ってこよう。

22:15 まもなく12月雇用統計発表

先物は小動き。

IVも先ほどからは特に変化なし。

ポジションも特に変化なし。このままNFPに突入。

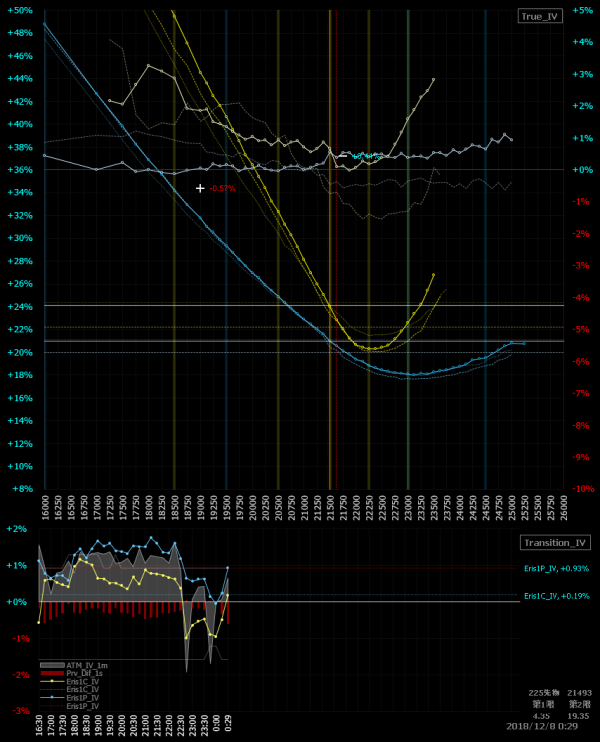

2018.12.08(土)00:30 全返済

「NFP」のあまりの無反応さに動揺していたところでNY市場オープン。NY勢に昨日までの勢いはなく、現在の水準で停滞やジリ下げされるとポジションにとってすこぶる都合が悪い。かといってこのポジションで「週越え」すれば、月曜日はほぼ確実に憂鬱な朝を迎えることになるだろう。

よってそろそろ見切りをつけて全返済しなければならない。今回のイベントプレイは完全に不発だった。猛反省。反面教師にしていただければと思う。

このスマイルカーブのようにイベント通過でATM~コールサイドのIVが最も落ちるのが一般的だ。つまりskewが立つ。わざわざITMのプットを売った理由はコレ。猛者はコール買+ミニ10枚売でDITMプット売玉を作るほどだ。今回は不発だったけど。

「プット・バック・スプレッド」の返済もFOTMプットの買玉から丁寧に返していこう。1円×枚数分しっかり損益に影響を与えるのを忘れてはならない。

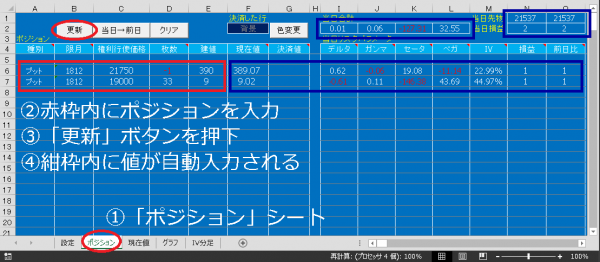

ポジションの返済が終わったら「スマイルキャッチャー」へ返済した値を入力しよう。

⑤赤枠内「決済値」に返済した値を入力

⑥「更新」ボタンを押下

⑦紺枠内の値が自動消去されて損益が固定される

以下の過去記事でも「プット・バック・スプレッド」の「イベントプレイ」を「シミュレーション」をしているので合わせてご覧ください。