“「皆が同じルールでトレーディングを行っていたにも関わらず、一日が終わるとはっきりと白黒が付くようになったの。誰が利益を上げて誰が損失を出したのか、誰の目にも明らかだった”≪リズ・シェヴァル≫

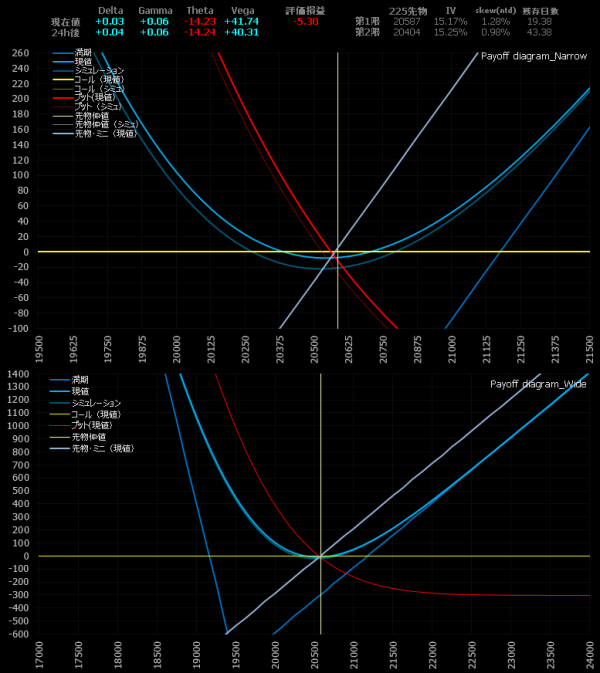

2019.02.07(木)23:50 プロテクティブ・プット エントリー NY市場オープン

欧州GDPの発表を受けて下げ進んだ日経先物、NY市場がオープンし、一旦は下げ止まっているように見える。

IVはコールがわずかに盛っているが、プットは未だ無反応。20500円を割れないと盛らないだろう。

先物が20500円のレンジの下限付近まで下落してきたところで、お決まりのプロテクティブ・プットをエントリー。三連休前のこれは明日にも盛りますね。最近は静かな相場ですっかりポジションを取る頻度が減ってしまった。あ、今日は1902月の最終売買日ということで、1つ変なポジションが見えるけど無視してください。

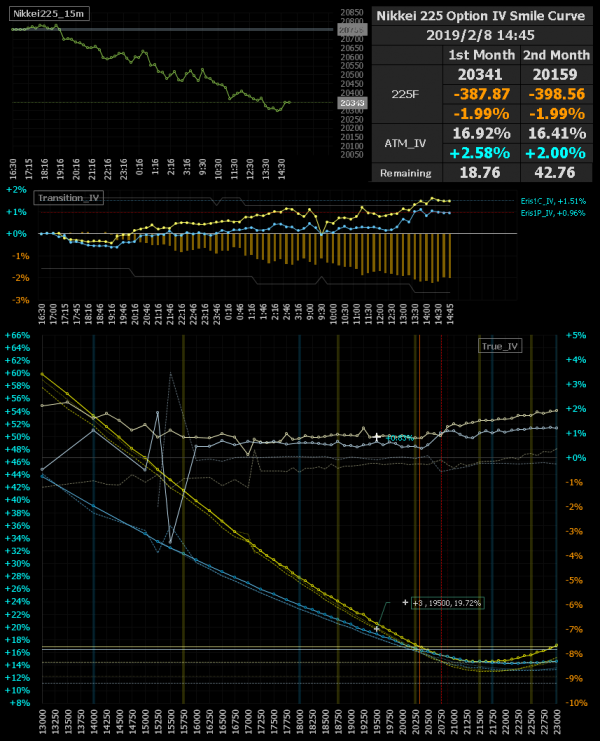

2019.02.08(金)14:45 東京市場クローズ

緩やかな下落が続く日経先物。東京市場は明日から三連休となる。

無反応だったプットはようやく反応してきた。1%程度の盛り。

ポジションはプロテクティブ・プットをホールド。

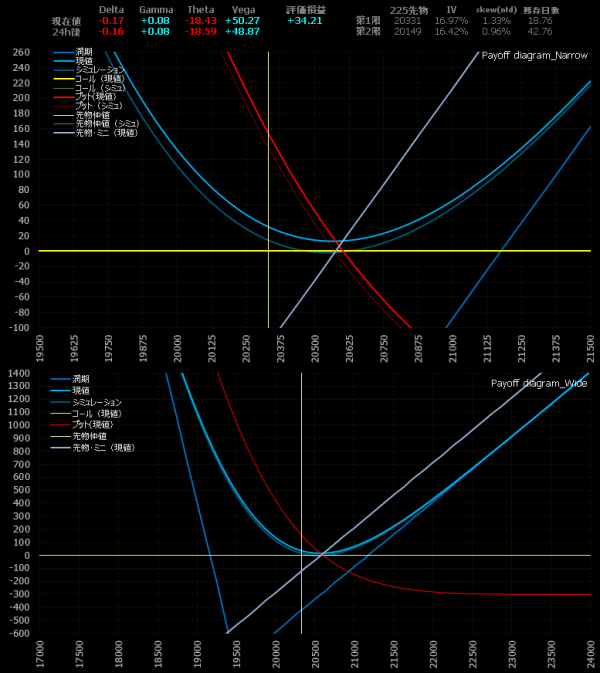

2019.02.08(金)22:05 欧州市場午後

先物一段安もプットがじわりと剥げる展開。

ポジションはホールド。しかしプットが剥げてもらっては困る。この後のNYオープンの様子を見て返そう。

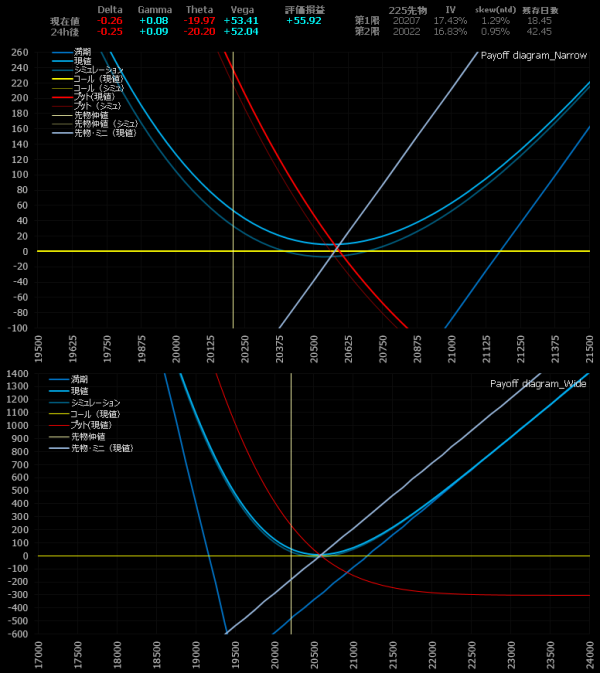

2019.02.08(金)23:30 NY市場オープン 全返済

ここまでリバウンドらしいリバウンドはないのだが、かといって昨晩のようにドカドカ下げ進む雰囲気でもない。今日のNYはいまいち方向感がなさそうに思える。またNSはプットもここまで微剥げ推移で都合が悪い。三連休前ということもあり、もはやプロテクティブ・プットもここまでのようだ。全返済。

1903M @+5qty 20575.00 JPY ー> close 20245.00 JPY (-165,000 JPY)

1903P19500 @+3qty 100.00 JPY ー> close 175.00 JPY (+225,000 JPY)

This profit and loss +60,000 JPY

Total profit and loss +60,000 JPY

三連休前にプットが盛ると思って取ったポジションだが、結局抜けたのは+1%弱とボラティリティ・トレード的にはイマイチな結果。しかし損益はプラスには違いない。やりにくい相場が続くが、しっかりと狙って引きつけて精度の高いトレードを行っていきたい。